6 min read

Most business owners are familiar with the basic financial reports they should be getting monthly.

Still, many are less familiar with the kinds of management reports available that could help their businesses increase performance and profitability.

|

Key Takeaways

|

As the CEO or owner, do you have information available at hand to answer these questions:

- Am I pricing my jobs right?

- Did I make more this quarter than last?

- Who are my most profitable customers?

- Do I have enough cash to make payroll?

- Who are my most and least productive staff?

Imagine your business potential if you had all the answers to these questions! You wouldn’t have to guess where you stand or how to improve the operation of your company.

How would you answer those questions? Hint: By looking at both your financial AND management reports! Most business owners don’t understand the difference between the two. So, let’s review.

Management Reporting vs. Financial Reporting

What Is Financial Reporting?

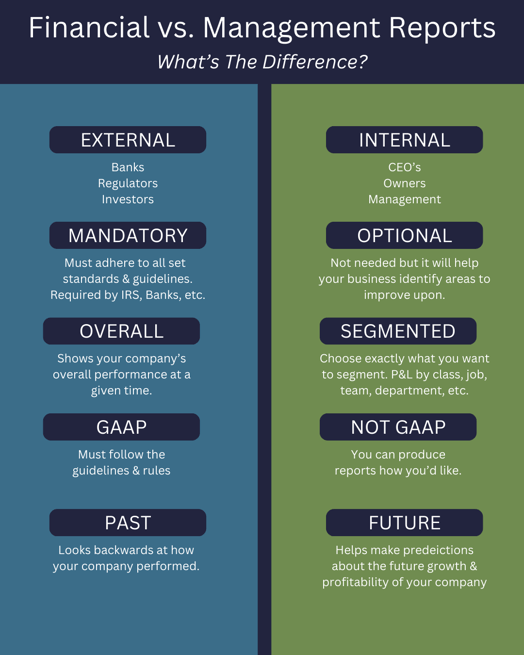

Financial reporting is compliance-oriented and is primarily used for external purposes. Financial reporting encompasses the standard weekly, monthly, and quarterly reports that companies receive each month.

Financial reports include:

- Profit and Loss Statement (Income Statement)

- Balance Sheet

- Accounts Payable

- Accounts Receivable

- Statement of Cash Flows

These reports are mandatory for all businesses. Banks, investors, and regulators use these reports to approve loans and lines of credit and to make sure you are following GAAP (Generally Accepted Accounting Principles).

These reports reflect the financial standing of your business at a specific point in time. They show the overall picture of how your company is performing but don’t give you real insight into the specifics of your operations. Financial reports look backward, and they do not provide much insight regarding how the business might perform in the next month or quarter.

What Is Management Reporting?

Management reporting, also called managerial reporting is a type of reporting that is hyper-focused on evaluating, assessing, and improving business management and operations. Management reports are analytical tools used by business owners and managers to improve operations. Managerial reports make it possible for you to dive deeper into your company’s financial standing.

Management reports include:

- Profit and Loss by Class (Department, Team, Job, etc.)

- Gross Margins

- Realization Rate

- Utilization Rate

- Customer Acquisition Cost

- Customer Lifetime Value

- ROI on Labor

- Employee Retention/Attrition Rates

- Budget vs. Actual Reports

- Cash Flow Forecast

- Trailing Twelve-Month Charts

Unlike financial reports, management accounting is not mandatory and is for internal use only. Your company is not required to follow GAAP guidelines when producing management reports.

Instead of an overall evaluation of the company, management reporting focuses on segments of the business. By segmenting, you can get into the details and analyze the drivers of your business.

For example, you can use management reports to assess the marketing department’s performance over a certain time period, or you could use management reports to determine how much profit one sales employee generated during a certain month.

Management reports are great for CEOs to gain insight into specific areas of their business.

Read More: How Much Do Outsourced CFO Services Cost?

The Number One Challenge With Management Reporting

There are countless management reports and metrics that you could generate using your business’s financial data. Thousands of key performance indicators and metrics mean that there are thousands of different management reports to choose from. As a result, the number one mistake business owners make with management reports is spending time on reports that aren’t relevant to their business or its goals.

It’s essential that you focus on the management reports and metrics that your business needs to drive strategic decision-making, instead of putting work into pulling reports that aren’t being acted upon.

When deciding which management reports and metrics are important for your business, take a close look at your operating framework and goals, both short and long-term. Are you wanting to increase profit margins by a certain percentage, improve employee retention, bolster employee productivity, sell more to existing customers, or acquire more customers?

Once you’ve determined your goals (make sure they’re SMART goals), consider how you can actually measure your progress in working toward and achieving those goals. These measurements, the ones that can help you track performance and progress, are the management reports that are worth spending time on.

Since your business’s goals won’t always be the same, you also won’t always use the same management reports. You might want to continue checking in on past areas of concern, but be sure that you’re constantly updating your package of management reports, metrics, and key performance indicators to maintain relevancy with your business’s current goals.

6 KPI Charts Every Business Leader Should Have At Their Fingertips

The One Page Scorecard Guide [DOWNLOAD]

Why Your Business Needs Both Financial and Management Reports

The Importance of Financial Reports

Of course, your business needs financial reporting for compliance, making sure the numbers are adding up, and preventing cash flow problems. Financial reports are required for external purposes, and they help you take the temperature of your business’s financial health.

The Importance of Management Reports

Your business also needs management reporting, so you can make better management and leadership decisions. Management reports facilitate data-driven decision-making. Management reports enable business owners to lead strategically with decisions based on solid financial data, rather than leading reflexively or reactively.

For many reasons, some business owners only want to focus on and dedicate resources to producing financial reports each month. For example, business owners often say that management reporting costs too much, they don’t have time for management reports, or they don’t believe management reporting will help their businesses.

What these business owners don’t realize, though, is that by foregoing the use of management reports each month, they are missing out on crucial information that could help their companies grow or prevent them from implementing costly programs that don’t even generate an ROI. In other words, management reports can help you strengthen your business, make money, and protect you from wasting money.

Get The Reports You Need With Your Outsourced Accounting Package

Here at GrowthForce, we go beyond just bookkeeping and accounting. We provide critical oversight and account management to ensure that the right policies, procedures, and systems are implemented to produce timely, reliable, and accurate financial and management reports. We help business owners run their businesses with total confidence backed by financial and management reporting they can depend on.

When you work with GrowthForce, you can count on accurate and up-to-date books. Based on your company’s needs. We will enter the financial data on a weekly basis and close your books at month-end.

We are experts in financial and management reporting and can provide you with the financial intelligence you need to make the confident and smart decisions that will help grow your company.

.png?width=563&height=144&name=New%20GF%20Logo%20(37).png)