7 min read

.jpg?width=682&height=455&name=My%20project%20(59).jpg)

The most important functions of your business are your core competencies or your company's main revenue sources (i.e. selling, producing, and improving the products or services you provide).

|

Key Takeaways

|

However, every business also relies on a handful of non-core competencies to operate. These include functions like marketing, legal, bookkeeping, and accounting. The financial non-core competencies are arguably the most important and integral to the operation, strategy, and success of your business because, well, without a back office, you won't even know if your business is profitable.

In small and medium-sized businesses, however, back offices are too often lacking in resources, people, and proper systems to operate smoothly, compliantly, and in a way that empowers and supports your ability to lead. The simplest and most effective solution to this all-too-common problem is outsourced accounting services.

What Are Outsourced Accounting and Fractional CFO Services for Small Businesses?

Outsourced accounting services and fractional CFO services are third-party providers that can establish, maintain, and operate back-office functions for businesses. These services include teams of bookkeepers, accountants, controllers, and even CFOs who establish bookkeeping and accounting systems and manage your business's back office.

Outsourced services can include anything from daily transaction entry, account reconciliation, payables and receivables management, and payroll to management reporting and financial strategy.

The Benefits of Outsourcing Your Back Office

Outsourcing your business's back office offers several benefits and advantages over hiring an in-house bookkeeping, accounting, and finance department.

In 2022, Deloitte's Global Outsourcing Survey [1] found that:

- 70% of business owners switched to outsourced accounting to reduce costs. The primary cost savings of outsourced accounting services is found in reduced labor costs. However, outsourced accounting can save your business in a variety of ways by improving the efficiency and productivity of your entire operation.

- 40% switched for the flexibility and scalability of outsourced accounting. Outsourced accounting services can be easily customized and scaled to meet your company's needs, as the business grows and changes.

- 20% switched to benefit from accelerating the speed to market facilitated by outsourced accounting. A highly organized back office facilitates optimal operations and financial transparency, helping new businesses raise funds and take their products and services to market quickly.

In addition to these top benefits of outsourced bookkeeping, accounting, and CFO services, your business will benefit from the following:

Saved Time

Outsourcing your back office will save you time. Many business owners wind up handling a large portion of back-office duties on their own. This, however, is not the highest-value way for business leaders to spend their time. With outsourced accounting, you can spend your time focused on running your business, managing your people, and strategizing for the future.

Comparing the Costs of an In-House Accounting Department vs. Outsourcing 👇

Click HERE To Download The Full Infographic (.pdf)

Access to Industry Experts and Top Talent in the Field

Due to budget restrictions and a lack of available upward mobility, your business most likely won't bring in the bookkeeping and accounting industry's top talent when hiring a finance team. When working with a high-quality accounting service provider, you will be able to access top experts in the finance industry who also have extensive knowledge and experience in your business's industry.

Optimal Coverage

Limited in-house bookkeeping and accounting departments suffer from coverage issues when employees get sick or take a vacation, and a short-handed back office can result in workflow disruptions, compliance issues, and fraud risks. With an outsourced provider, your business won't suffer from these kinds of employee coverage problems.

Improved Compliance

Outsourced accounting providers take on responsibility for keeping your back office operations and financial reports up to industry standards as well as local and national regulatory standards. Outsourced providers ensure your company is compliant, helping you avoid both financial and reputational damage that could arise as a result of non-compliance.

Read More: Cost Analysis: Outsourcing vs. In-House Accounting for Your Business

Stronger Fraud Prevention

Since they typically don't have the most robust back offices, small and medium-sized businesses are often among the most susceptible to fraud, especially internal fraud. Outsourcing your back office ensures your books are handled properly with sound systems, policies, and procedures in addition to the implementation of dual control and the proper checks and balances. Outsourcing your back office not only helps to prevent fraud from occurring but it also shifts the burden of fraud risk to your third-party provider.

Powerful Financial Insights and Better Business Leadership

Outsourced CFO services provide your business with financial insights and guidance that will help you make data-driven decisions to lead your business. Financial insights can help you cut costs (smartly), increase productivity, improve operations, perfectly time hiring, optimize pricing, maximize profits, and so much more.

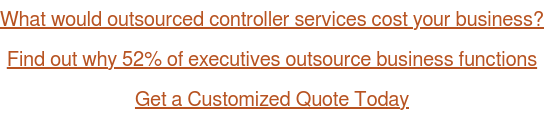

Build a CFO and accounting package that helps your business meet profit goals.

Learn more about our a la carte menu of services.

So, How Much Do Outsourced CFO Services Cost?

The exact price tag of outsourced accounting services and CFO services depends on several factors such as the level of services your business signs up for and the size of your business (i.e. the volume of transactions and reports being handled by an outsourced provider).

On average outsourced accounting and CFO services can cost a business about 40 to 60 thousand dollars annually. These sums are typically paid over the course of a year with a monthly flat fee based on the type of service package selected.

The Cost of an In-House Bookkeeping and Accounting Department

Compared to the cost of hiring an in-house accounting department, the cost of outsourcing your back office is nominal. A complete finance and accounting department consists of (at a bare minimum) a bookkeeper, accountant (CPA), controller, and chief financial officer. With the following average salaries and average salary ranges, according to Salary.com, these positions are not cheap to fill:

| Bookkeeper | $42,854 ($38,326 to $47,569) [2] |

| Accountant | $86,880 ($54,940 to $118,830) [3] |

| Controller | $245,123 ($206,137 to $287, 557) [4] |

| CFO | $427,000 ($323,500 to $547,700) [5] |

Just considering salaries alone, your company could be looking at an average of over $800,000 annually to hire this four-person financial department. As every business owner knows, employees cost much more than their salaries – paid time off, benefits, insurance, payroll taxes, IT, office space, and more. When you consider fully loaded labor costs, the price of an in-house financial team can quickly stretch beyond the budgetary means of a small or medium-sized business.

When compared to the costs and benefits of outsourced accounting, the financial savvy choice seems fairly obvious.

Read More: 6 KPI Charts to Drive Performance & Profitability in Small Businesses

Experience the ROI of Outsourced CFO Services

While considering the cost of outsourced accounting – a small fraction of the cost of in-house financial staff – it is also important to consider the potential return your business stands to gain as a result of the above-listed benefits. You can better lead your business to a successful future with a back office that's focused on maximizing ROI on every dollar your company spends through improved operations, better human resource management, and financially optimized growth strategies.

[1] https://www2.deloitte.com/us/en/pages/operations/articles/global-outsourcing-survey.html

[2] https://www.salary.com/research/salary/benchmark/bookkeeper-salary

[3] https://www.salary.com/research/salary/general/accountant-salary

[4] https://www.salary.com/research/salary/benchmark/controller-salary

[5] https://www.salary.com/research/salary/alternate/cfo-salary

.png?width=563&height=144&name=New%20GF%20Logo%20(37).png)