7 min read

.jpeg?width=682&height=431&name=AdobeStock_587290905%20(1).jpeg)

The three essential financial statements that every business leader needs to know how to read and interpret include the balance sheet, income statement, and cash flow statement.

|

Key Takeaways

|

These three financial reports can help you track the financial health of your business with useful metrics called key performance indicators while identifying strategies to improve the business's overall performance.

How to Read and Interpret a Balance Sheet

What Is a Balance Sheet?

A balance sheet is like a snapshot of a business's financial position on a certain date. It contains all of the information necessary for calculating the accounting equation: assets = liabilities + owner's equity. The balance sheet keeps track of a company's assets (what value you have on hand), liabilities (what you owe), and owner's equity (how much shareholders have invested in your company).

The Parts of a Balance Sheet

- Assets - Assets include anything with a quantifiable value that is owned by the company (cash, receivables, equipment, inventory, investments, etc.).

- Liabilities - Liabilities include any money the company owes (accounts payable, long-term debt, taxes, outstanding payroll, rent, utility costs, payable bonds, etc.).

- Owner's Equity - Owner's equity essentially represents the net worth of your business, as it is the amount that would be left if you were to sell all o your assets and pay all of your debt. Owner's equity is the amount of money that you and your shareholders have invested in the business in addition to your retained earnings.

Read More: Financial Reports vs. Management Reports: What’s the Difference?

How to Use a Balance Sheet

The balance sheet contains multitudes of information, but to get started, you can analyze it using a few common financial ratios:

- The Current Ratio = Current Assets / Current Liabilities

- The current ratio reveals how liquid a company is (i.e. how easily it can pay its bills). Generally, a company with a current ratio below 2:1 could eventually run into cash flow trouble. With a current ratio below 1:1, the company does not have enough cash on hand to cover its short-term liabilities. Conversely, a current ratio that is too high could demonstrate a company that is not leveraging its assets well for growth.

- The Quick Ratio = (Cash and Cash Equivalents + Accounts Receivable + Marketable Securities) / Current Liabilities

- Also referred to as the "acid test," the quick ratio is similar to the current ratio but only considers assets that are highly liquid (i.e. cash and assets that can be quickly converted to cash). The quick ratio needs to be 1:1 or higher to ensure your business has a healthy cash flow for covering costs and payments.

- The Debt to Equity Ratio = Total Debt / Owner's Equity

- This ratio compares long-term debt in a business to the owner's equity. It largely reveals how a company is financed. If total debt is greater than the owner's equity, it reveals a company that has not yet built up much value. If the owner's equity is greater than long-term debt, then the company is mostly being run on an owner's cash or shareholder investments, meaning the business is worth more than if it were financed by mostly debt.

The best-run companies are data-driven.

Build an accounting package that helps your business grow.

Learn more about our a la carte menu of services.

How to Read and Interpret an Income Statement

What Is an Income Statement?

Also referred to as a profit and loss (P&L) statement, the income statement shows you how much money your business has generated and spent over a given period of time. Income statements can be used to report activities, identify trends, and compare performance across various financial periods.

The Parts of an Income Statement

- Revenue - The business's revenue (the amount of money the business took in) during the specified financial period

- Cost of Goods Sold (COGS) - Direct or variable expenses (the money spent on producing the products or services that generated the revenue

- Gross Profit - The money left over after subtracting COGS from total revenue

- General Expenses - Indirect or overhead expenses (the money spent to keep the business running such as rent, utilities, office supplies, etc.)

- Operating Income - The amount left after subtracting operating expenses from the gross profit (also known as earnings before interest, taxes, depreciation, and amortization (EBITDA))

- Income Tax and Interest Expense - The estimated tax and interest cost for the reporting period

- Net Profit - The income left after subtracting tax and interest expense

How to Use an Income Statement

Income statements are used to assess the financial health of a business. They can tell you whether or not a company is profitable, how much money the company spends to generate a profit, and whether or not any money is left over to reinvest in the business. They can also help you identify financial trends in the business such as increasing or decreasing costs or seasonality in revenue.

The income statement also provides the data needed to calculate a few vital key performance indicators such as:

- Gross Profit Margin = (Revenue - COGS) / Revenue

- Gross profit margin is gross profit represented as a percentage or rate of total revenue. This metric reveals how much of each dollar earned your business actually keeps. It shows how much is left in every dollar of revenue to cover indirect costs and grow the business. Gross profit margin is one of the most important metrics in business, as it strongly correlates with business health. Margins that are considered healthy can vary quite a bit between industries and business models, but generally the greater the margin, the stronger the business.

- Operating Profit Margin = Operating Income / Revenue

- The operating profit margin is similar to the gross profit margin, but it also takes into account overhead expenses. This metric can help you determine where you can most effectively cut costs in order to retain earnings and reinvest in your business.

- Net Profit Margin = Net Income / Revenue

- The net profit margin is similarly represented as a percentage, and it reveals the total amount of money retained by a business after all costs and expenses are considered. This reveals the percentage of pure profits that a business can use to reinvest, save, or pay out to shareholders.

How to Read and Interpret a Cash Flow Statement

What Is a Cash Flow Statement?

The cash flow statement accounts for the money flowing into and out of a business over a specified period of time. The cash flow statement is arguably the most important of these financial reports because it reveals a business's actual ability to operate.

A positive cash flow statement shows that more money is coming into the company than flowing out of the company, and a negative cash flow statement means that more money is flowing out of the company than is coming into it. A negative cash flow statement can reveal serious problems in a business's finances and requires cash reserves, cash injections from investors, or debt to cover.

Read More: 28 Ways To Improve Your Cash Flow Management

The Parts of a Cash Flow Statement

Cash flow statements include the following sections:

- Cash, Beginning of Period - The cash on hand that was available at the beginning of the period

- Cash Flow From Operating Activities - This category includes line items for net income, additions to cash, depreciation, increases in accounts payable, subtractions from cash, increases in accounts receivable, and net cash from operating activities.

- Cash Flow From Investing Activities - Cash flow from investing activities includes line items for activities such as using free cash for buying or selling assets including both physical and non-physical property (real estate, equipment, vehicles, patents, etc.).

- Cash Flow From Financing Activities - This section includes the details of cash flow from debt and equity financing, loans, interest earned, draws, and other capital contributions from owners or shareholders.

- Cash Flow for Specific Period - This line shows the total cash flow for the period.

- Cash Flow at End of Period - This line shows the total cash flow for the period plus the starting cash amount.

How to Use a Cash Flow Statement

You can use your cash flow statement to calculate the following metrics:

- Current Average Liability Ratio = Net Cash From Operating Activities / Average Current Liabilities

- This ratio can help you determine whether your business has enough incoming cash flow to cover its immediate obligations. (To use this ratio, you must first calculate your average current liabilities by adding the previous period's current liabilities to the end of the current period's liabilities and dividing by two.)

- Cash Flow Coverage Ratio = Net Cash Flow From Operations / Total Debt

- This ratio is similar, but it evaluates the company's ability to cover both short and long-term debt, rather than just immediate obligations.

- Cash Flow Margin Ratio = Net Cash From Operating Activities / Net Revenue

- This ratio reveals how much a business earned on every dollar in revenue over the specified cash flow period.

Best Practices for Financial Reports: Why You Need Them

You should instate in your business a set of best practices for both generating financial reports and for reading/interpreting your financial reports. These best practices should include accurate, timely, and sound processes, procedures, and policies for data collection and report generation in addition to a set routine for evaluating your financial reports.

This will help you keep a close eye on the financial health of your business, avoid cash flow challenges, and identify financial opportunities that you might be missing. Additionally, these reports can help you improve the overall operation of your company for increased profits and success.

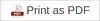

The Power of Outsourced Accounting for SMBs

SMBs often find it difficult to establish a sound set of financial report best practices while automating data collection and report generation with a reasonable back-office budget. Outsourced accounting, however, can help you get your back office in order and working for you at a fraction of the cost of hiring a full, in-house team. With an outsourced back office, you'll have reliable data, timely financial reports, and a knowledgeable team ready to help you evaluate your business's financial health and make data-driven decisions to lead your company to success.

.png?width=563&height=144&name=New%20GF%20Logo%20(37).png)