.jpeg?width=682&height=383&name=AdobeStock_470168547%20(1).jpeg)

There are huge differences between a tactical CEO, and a strategic one. Being tactical means you’re focusing each day on cash flow, survival, and the most urgent task to hit your desk– regardless of its level of importance. These CEOs are working IN the business 100% of the time, not ON the business. They’re putting out continual fires that crop up in order to stay afloat.

Making that shift from being tactical to being strategic, where you divvy your time in the most effective way to further your company’s goals, isn’t easy. That said, it’s a significant moment for how your business is run, and can pave the way for success.

Let’s talk about the difference between tactical and strategic CEOs, and how you can implement the proper systems in place for continual growth and profitability.

Tactical CEOs

As we mentioned before, tactical CEOs are ridden with problems and fires. The major ones include:

- Making payroll and dealing with cash flow

- Fear of charging your full fee of services, or risk losing work you desperately need

- Sales opportunities

- Keeping clients happy

- Hiring and employee turnover problems

All of these fuel each other in a downward spiral. Let’s go into more detail of each:

Payroll/Cash FlowAmong the biggest fires for tactical CEOs include making payroll, and the constant worry of whether you have enough funds to pay your team. This constant fear can lead to bad decisions and an insecure position in the business.

In turn, this then prompts you to being afraid to charge your full fee, because you risk not getting the job. If getting the next deposit check will make or break job for paying your team, chances are, you’re going to discount your services in order to ensure you get that job.

But trust us when we say that’s the death knell of a business, because if you discount and cut corners, you’re going to suffer worse cash flow problems in the long-term.

This is the crux of why so many businesses fail.

With an unpredictable cash flow, you also can’t take advantage of opportunities such as a supplier sale due to an overrun of inventory. Here’s an example :

Say a supplier calls up and says “Hey, we’ve got a special discount on widgets, I can give you 20% off if you buy 100 of them.” What happens if you don’t have the cash – now you’re placed at a competitive disadvantage, because if they DID have the cash and bought the stock at a 20% discount, they’ll undercut you.

Ouch. That’s an associated pain from being a tactical CEO transfixed on cash flow.

Client ProblemsHaving happy clients is paramount, and any screaming customers can quickly suck up an entire day’s worth of your time. That’s because without a happy customer, you don’t get that next check- which if you're a tactical CEO, you probably really need!

You’re then driven back into the destructive chain of making decisions out of fear of losing a client.

Employee RetentionBeing a tactical CEO, you’re burdened with replacing those who left quickly. The resulting pain? Hiring people who may or may not be a good fit – you’re in a tough spot, and have to bring on team members who can do the work that’s assigned. Hiring people because they can “fog a mirror” directly impacts the chance of a high performing team.

This is especially impactful when a business is run on tribal knowledge, and when a member of that tribe leaves, so, too, does the knowledge.

CEOs Role

A tactical CEO follows a hierarchical chain of command, where they’re at the top giving orders, when in fact, it should be the opposite. The staff should be at the top – and the CEOs job is to support the people doing the work, and sales shouldn’t drive every next move and decision that’s made.

Then you’re struggling to not be able to pay bills until a check clears, and this perpetuates a downward spiral. If there’s a fundamental issue that isn’t being addressed, you’ll keep hitting those problems as a tactical CEO.

Strategic CEOs

Now that we’ve covered what NOT to do, it’s time to discuss what you SHOULD do and it all boils down to strategy. You must focus on, first and foremost, the overall strategy and plan for the business. Strategic CEOs ask themselves what’s going to be done this quarter, month, week, and day to propel the company’s goals and mission statement.

This can be fully realized when you spend 20% of your time to plan for the remaining 80% – or one full day a week; a quarterly and annual retreat; however you want to fit it in. Either way, it’s working ON the business, not IN the business.

Here are some things you can do as a strategic CEO:

- Define a plan to accomplish the business’s vision

- Review that vision/goal every quarter

- Share everything with the company

- Celebrate the successes with your team

One of the things a strategic CEO should focus on is getting the right people in the right seats on the bus and then manage them to drive performance as a team.

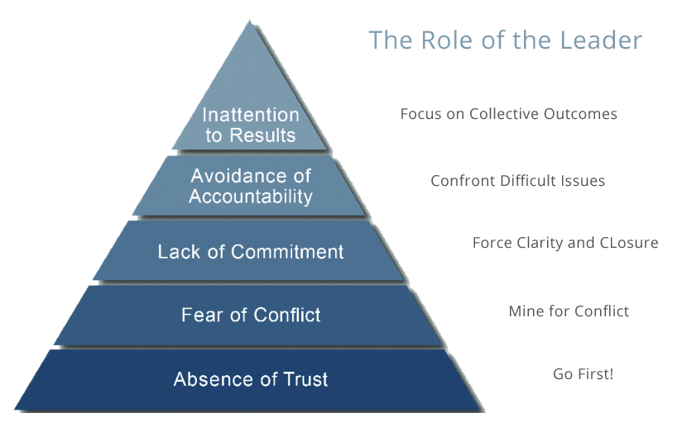

Here at GrowthForce, we went through something called Five Dysfunctions of a Team. Basically, it taught us we had work groups and not teams. I was telling everyone what to do, and they'd go do it, but that’s not teamwork. Being a strategic CEO means you’re focusing on leadership, and adjusting your leadership style to your team.

We mentioned before a strategic CEO means defining the vision and the plan to get there. This includes monthly, quarterly and annual budgeting, and three to five year forecasting.

By budgeting, and reviewing actual vs. budget comparison reports, you can accurately compare and understand your numbers and how the company is doing over time. You’ll have a reliable benchmark to review what’s working and what’s not.

Knowing Your ProductYou, as a CEO, should really understand your product and whether it can be improved. You should be constantly searching for “wow” experiences for clients. This means investing in the right training – specialized training, if necessary – for your staff, all in the name of wowing clients. It should always be about serving clients.

Don’t be afraid to reach out to your best clients and figure out why they bought from you. What was the emotional reason why? Because it’s all about establishing a relationship with that client, so studying the emotions you’re meeting with a client are important.

In our business many clients are looking for peace of mind with their accounting. Our processes and procedures allows us to provide that by uncovering inconsistencies, like “Hey, there was a withdrawal from your bank account in this amount. We don’t have any record of that.”

So take a moment to ask yourself as a strategic CEO, “Why did this person buy from us? Why do people stay with us?” This means you’re truly working on the product.

Studying the Ideal CustomerFinding who’s the right fit for your business is extremely important. Only 20% of people who apply to become a client of GrowthForce are qualified. Why?

Because if you don’t have the right revenue or the right industry that’s perfect for us, or if you don’t have the right psychographic, maybe you don’t believe in outsourcing, or you don’t see the value in financial intelligence so you, you don’t qualify. Simple as that.

A strategic CEO helps their company understand and identify who’s qualified to be a client. That way, you can deliver the maximum amount of value for them. For GrowthForce, we deliver value to service businesses and nonprofits – retail and restaurants, not so much.

Strategic CEOs Keep Score

Being obsessed with numbers, and sales and marketing efforts, is integral for strategic CEOs. Measuring and monitoring your numbers help you to pinpoint what’s broken and understand where you need to allocate resources for a fix.

To learn more about being a strategic CEO, check out our newest eBook on “Keeping Score”...

.png?width=563&height=144&name=New%20GF%20Logo%20(37).png)