7 min read

October 30th, 2024

.jpeg?width=942&height=456&name=AdobeStock_460322183%20(1).jpeg)

At the top of a CEO's list of worries, you'll find economic uncertainty (especially concern over a potential recession) and inflation, according to the 4Q 2023 Business and Industry Economic Outlook Survey from the AICPA and CIMA

|

Key Takeaways

|

In addition to these economic concerns, CEOs also worry that they have too many or too few employees to satisfy the current demands on their businesses. While these are valid concerns of CEOs and business owners, the solutions to these challenges can come from the vital support a CEO receives from their chief financial officer (CFO).

A CFO is the most senior position within a business's financial department. In addition to overseeing the business's finances, bookkeeping and accounting systems, and back-office employees, CFOs are key financial strategists within businesses and provide invaluable guidance, advice, and support to CEOs.

What Is a Virtual CFO?

While the traditional CFO is an in-house, c-suite employee, a virtual CFO is a third-party, outsourced, chief financial officer. A virtual CFO serves a business remotely on an as-needed basis. Virtual CFOs are also sometimes referred to as fractional CFOs, outsourced CFOs, or vCFOs.

Read More: How Much Do Outsourced CFO Services Cost?

The Role of a Virtual CFO for CEOs

The role of a virtual CFO is fairly malleable, meaning their services can be adjusted to meet the changing and evolving needs of every unique business. So, the role of a virtual CFO in your business might differ from that of another company.

A virtual CFO can offer several services designed to support a CEO in his or her function and role within a business, such as:

- Be a source of financial expertise.

- Provide solutions to economic worries with financial strategy, planning, and advice.

- Offer short-term and long-term planning.

- Help build a strong financial foundation.

- Establish efficient back-office systems for data collection, compliance, and reporting.

- Establish sound back-office systems to mitigate fraud risk.

- Use the back office to improve operational efficiency and increase productivity.

- Help manage and support business growth.

- Improve hiring timing to support growth and match economic demand.

- Maintain tax and audit readiness.

- Assist with major projects.

The role of a virtual CFO can be almost anything a CEO requires because the purpose of fractional CFO services is to assist CEOs and lighten the burden of financial management, planning, and strategy while providing expert guidance and advice.

A Quick CEO Guide to CFO Services: What CEOs Need to Know About Virtual CFO Services

The Benefits of CFO Services

CEOs can leverage several potential benefits of virtual CFO services. While the specific benefits a business receives depend greatly on the types of services you require from a virtual CFO, these are some of the most common.

- Cost Savings - An in-house CFO comes with an average base salary of $450,000 in the United States. Virtual CFO services cost an average range of $1,000 to $2,500 per day or about $5,000 to $12,000 per month depending on the package of services and payment or subscription model. If your business isn't currently spending anything on a CFO, then you can still save money by generating an ROI on virtual CFO services through increased operational efficiencies and improved financial health.

- Time Savings - A virtual CFO's support saves loads of time that a CEO would otherwise spend on back-office tasks. This frees up the CEO to focus their time and energy on the business's core functions.

- Better Financial Management - A virtual CFO uses vast experience and knowledge to improve financial management. This includes smarter spending, planning, saving, structuring, and strategy.

- Flexibility and Scalability - Outsourced CFO services can be scaled and modified to meet your changing needs.

- Improved Compliance - Virtual CFOs keep up with ever-changing financial regulations, tax codes, and industry requirements to clean up financial compliance, avoid penalties, and maintain a good reputation.

- Improved Security - A business's back office needs the proper checks and balances, separation of duties, and secure systems to operate soundly, reduce risk, and prevent fraud.

- Better Financial Strategy - A virtual CEO will provide you with tools to improve the data collection to support financial forecasting and modeling. This data can then be used to create a solid financial strategy designed to improve operations and promote growth.

- Improved Business Strategy - A virtual CFO will work with the CEO to provide a financial strategy designed to support the business's overall short-term benchmarks and long-term goals.

CEOs should be aware of all the potential advantages that virtual CFOs can provide so that they understand the specific ways their businesses can benefit from CFO services.

Read More: The Pros & Cons of Outsourced Accounting Services

When Your Business Needs a Virtual CFO

CEOs should be able to recognize when they require the assistance of a virtual CFO. The following are some of the most common signs that your business could benefit from CFO services:

- You don't have complete, accurate, reliable, or timely financial data.

- Your back office doesn't operate smoothly.

- You spend too much time on bookkeeping and accounting tasks.

- You have cash flow problems and are always running short on cash.

- You don't have a financial plan or strategy.

- You struggle to make a budget for your business.

- You lack financial expertise.

- You need someone to talk with you about your business, ideas, and strategy.

- You need more time to work on your business, rather than in your business.

CFO services can also greatly benefit CEOs who are facing novel or temporary challenges such as undergoing a merger or acquisition, preparing an exit strategy, or looking for opportunities to expand.

How to Use CFO Services

The way you use CFO services depends on your needs and is largely up to you. For example, some CEOs choose to use CFO services on a regular basis each month so that they can better understand their financial reports and keep an eye on financial health and planning. Other CEOs choose to enlist the services of a virtual CFO on a more temporary basis, looking for assistance or guidance with a special project.

For this reason, it's essential that you know your business's needs when beginning a relationship with a virtual CFO. This will help ensure that you take advantage of the services (and level of services) that can best support your business.

6 KPIs Every CEO Should Track

A guide to help you measure profitability and performance in your business.

[DOWNLOAD]

How to Choose a Virtual CFO

There are several different types of virtual CFOs (e.g. independent contractors and outsourced accounting firms that offer virtual CFO services). Additionally, these providers offer a wide array of services, packages, and levels of service. When looking for a virtual CFO for your business, you should:

- Know your business's needs.

- Choose a provider with experience in your industry.

- Check their credentials, experience, and qualifications.

- Read reviews and ask for references.

- Find someone who fits your business's culture and values.

- Determine whether or not they can provide a strategic vision.

- Ask how and how often they communicate with clients.

- Choose a tech-savvy provider who can help you establish, improve, and automate your back-office systems.

- Look for flexibility, scalability, and customization.

- Determine whether or not their pricing fits your budget.

How to Work with a Virtual CFO and Make the Most of CFO Services

When working with an outsourced CFO, there are a few things you can do to make the most of the working relationship:

- Set and communicate your goals for the relationship. Be sure you know and your virtual CFO knows what you expect to get out of their services.

- Communicate clearly and regularly.

- Ask plenty of questions about what they provide, the financial information you receive, and how they can help you improve your business and your role as CEO.

- Learn and use the systems they implement (and provide training to necessary employees) to ensure thorough data collection for the best results.

Reap the Rewards of Virtual CFO Services for Businesses

If you are a CEO or business owner feeling overwhelmed by the financial side of your business - whether that be day-to-day management, staffing, budgeting, reporting, or strategic planning - then a virtual CFO can help you be a better leader while saving your business money.

To learn more about virtual CFO services, how they can help you be a better CEO, and what they can do to strengthen your business, we encourage you to learn more about outsourced accounting and request a consultation with a GrowthForce professional today.

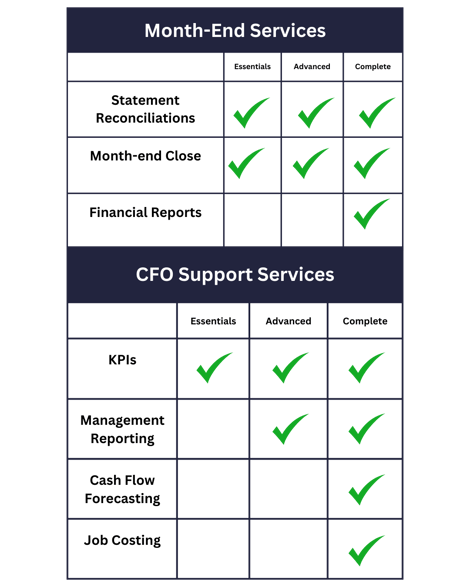

Build a CFO & accounting package that helps your business grow.

Learn more about our à la carte menu of services.

.png?width=563&height=144&name=New%20GF%20Logo%20(37).png)