5 min read

Outsourced accounting, bookkeeping, and controller services have become a more common solution for small businesses today. Why? The advantages, which once were only enjoyed by mid-market and enterprise companies, are becoming understood by smaller companies.

|

Key Takeaways

|

With a remote, U.S. based accounting team, CEOs and business owners have access to knowledgeable, trained staff working to help their business run better, grow faster, and make more money. Often at a significant cost savings vs. building an internal accounting department.

Why Do Companies Outsource?

Cost savings, focusing on core business functions, and solving capacity issues are primary drivers to outsource. Leading organizations use outsourcing to drive transformational change and improve business results.

As with any good decision, it starts with weighing the pros and cons so you can evaluate whether outsourced accounting is right for your organization.

Pro #1: More Cost Effective

Hiring an outsourced accounting service is often cheaper and more cost effective than hiring in-house staff to handle the finance function. By outsourcing, you don’t have any attributed overhead costs that hiring an employee would generate, such as PTO, health insurance, retirement, vacation, Workers’ Comp, and sick days. Also, the value of having an entire team’s expertise, rather than just one internal person (or more), includes reducing the risk of non-compliance and unreliable financials – especially for smaller businesses starting out.

Read more: How Much Do Bookkeeping Services for Small Businesses Cost?

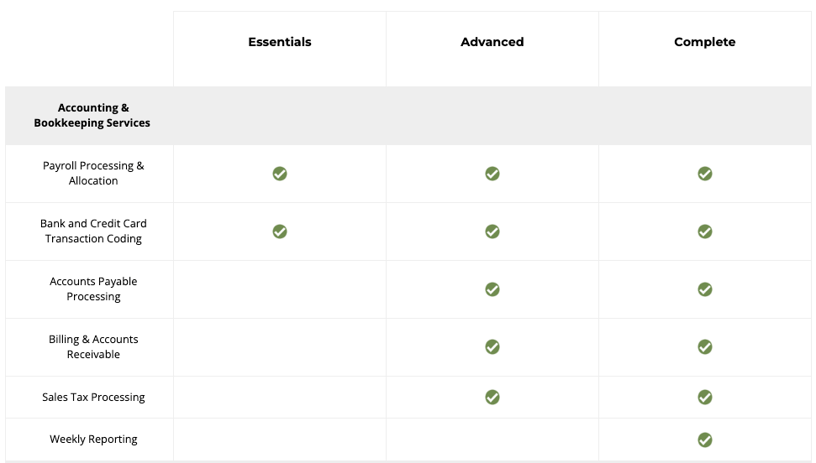

The best-run companies are data-driven.

Build an accounting package that helps your business grow.

Learn more about our a la carte menu of services.

Con #1: Hidden Costs

With any paid service, scope creep can happen where one task ends up snowballing into multiple, and it can result in additional costs you weren’t initially aware of (or forgot about). Be sure to make your month-to-month relationship clear, and expectations set at the beginning so it minimizes the chance of this happening. We’ve got a comprehensive 5-step process that you can follow to gain clarity on how the onboarding process works, if you’re unsure.

Pro #2: A Proactive Approach

As a CEO, you didn’t go into business to be a trained financial professional overseeing the books. You want to run your business and focus on the overall growth and vision of the company itself. This is why having an outsourced accounting team has the advantage of proactivity, where they can spot red flags ahead of time and notify you about expenditures and cash flow, for example. Having trained eyes on your finances at all times can bring considerable peace of mind, as well as the confidence needed to make intelligent financial decisions.

How do the costs compare to your in-house back office? 👇

Con #2: Less Control

With proactivity of an outsourced team DOES come a caveat – you can’t walk down the hall to ask about every single financial event that takes place. Of course, you’ll be able to call your account manager, get weekly updates and receive monthly reports, but it requires trust in your outsourced relationship.

For business owners, handing over the control of the books can sometimes feel uncomfortable. Starting out with an in-depth onboarding process that defines roles, policies and procedures sets expectations and ensures communication is timely.

Pro #3: Reduced Fraud

Fraud is an unfortunate result in many small to medium-sized businesses with one person at the helm of accounting. That’s because it’s easy to manipulate the books, or have a fake expense go unnoticed for months, or even years. There are multiple warning signs that can indicate fraud and are oftentimes because of a hardship an employee’s going through, where they feel financial pressure and don’t know what else to do. Don’t just blindly trust your employee without any controls or accountability – it’s a surefire sign to leave you wide open for fraud.

With outsourced accounting services, you have multiple pairs of eyes on your transaction processing and reports, which provides increased internal controls. While fraud can never be ruled out 100%, a dedicated team with specific expertise in accounting best practices will be far more likely to spot an anomaly than one person who’s probably overburdened and overloaded with work.

Con #3: Not Local

There are, of course, benefits to having an employee in-house to answer questions immediately. While an outsourced team is available, answers may not always be instant. There may be limitations from not being in the same office. But with the right outsourced accounting firm, they should have good communication policies in place to ensure your team is available and easy to reach. It’s important to weigh the options on what’s the highest priority – an instant response, or the due course taken to get the right answers.

If you don’t establish a communication schedule, and the division of responsibilities with your outsourced provider, it will make an outsourced relationship murky and difficult to manage once it begins. Take the time to discuss this, including your goals for the outsourced team.

A Dedicated Outsourced Accounting Team Can Skyrocket Your Growth

From an advanced outsourced accounting team, to customized management reporting and controller services, your outsourced accounting service is designed to augment your staff and transform your finance function. It’s not just about maintaining your accounting, but also providing a platform to drive profits, improve cash flow, and grow your business.

Here at GrowthForce, we’ve helped businesses and nonprofits of all sizes, gain the peace of mind, efficiency, and actionable financial intelligence they need to succeed. Contact us to start a conversation...

Read More: What's the Difference Between Cost Accounting and Management Accounting?

.png?width=563&height=144&name=New%20GF%20Logo%20(37).png)