7 min read

.jpeg?width=775&height=436&name=AdobeStock_545630692%20(1).jpeg)

Contribution margin is the kind of bland-sounding term that can quickly lose a business owner's interest. Although "contribution margin" sounds boring, it is actually an exciting and powerful metric you can use in your business to access your untapped potential for profitability.

|

Key Takeaways

|

Contribution margin is an essential metric to track, evaluate, and work to improve. Learning how to use it to your advantage can help you cut costs in the right places and make data-driven decisions to boost your business's profits.

What Is Contribution Margin?

The contribution margin is a metric used to measure the amount of revenue left over after a product or service's variable costs have been covered. The contribution margin reveals how profitable a product or service is to produce or provide. The contribution margin is expressed as a dollar amount, and the contribution margin ratio is expressed as a percent.

With unit economics, the contribution margin can be used to evaluate a business's profitability as a whole, the profitability of its products or services by type, or the profitability of individual products and services.

Calculating the Contribution Margin and Contribution Margin Ratio

You can calculate the contribution margin and contribution margin ratio using the following formulas:

Contribution Margin Formula

- Contribution Margin = Revenue - Variable Costs

Contribution Margin Ratio Formula

- Contribution Margin Ratio = Revenue - Variable Costs / Revenue

Understanding the Components of the Contribution Margin Formula

- Revenue - Revenue (also known as net sales or sales) refers to the money generated by the sale of services or goods.

- Variable Costs - Variable costs (also known as direct costs) include the money spent on expenses that are directly related to producing goods or services. Variable costs also fluctuate in relation to production volume, labor, and suppliers. With variable costs, increased production usually equates increased variable costs. Common variable costs include direct labor, sales commissions, raw materials, machinery maintenance costs, shipping or freight costs, transportation costs, and utility expenses that are related to production.

Contribution Margin vs. Gross Margin – What's the Difference?

Gross margin (also referred to as gross profit margin) is commonly confused with contribution margin. The two, however, are different metrics. Understanding both and knowing how they differ can be highly beneficial to management and business growth.

The difference between gross margin and contribution margin can be found in the formulas:

Gross Profit Formula

- Gross Profit = Revenue - Cost of Goods Sold

Gross Margin Formula

- Gross Margin = Revenue - Cost of Goods Sold / Revenue

As you can see, the gross margin ratio is calculated using the cost of goods sold instead of variable costs. The formula subtracts the total cost of goods sold (fixed and variable costs), instead of only the variable costs of production.

Gross margin expresses the revenue left over after COGS as a rate or percentage. The gross margin shows how much money is left over in a company's total revenue after both direct and indirect costs have been subtracted.

While the difference between the two might seem slight, it has a significant effect on the way you can use these two metrics in your business.

8 Reasons Why You Should Be Tracking Your Contribution Margin

1. Measure the Impact of Variable Costs on Profits

The contribution margin isolates variable costs in order to better evaluate your production costs and how they impact your profitability. One of the most useful ways to use contribution margin is to leverage the information it provides regarding the impact of variable costs, specifically, on profits. Since gross margin takes into account total COGS, contribution margin is the best metric for measuring variable costs and the direct impact they have on profits.

For example, growing contribution margins indicate a reduction in variable costs. This could be a sign of better vendor prices or increased productivity in your workforce. On the other hand, shrinking contribution margins indicate increasing variable costs. In these cases, you should take a look at your variable costs, line by line, to determine whether supplies or other costs are increasing or if you might have a productivity problem on your hands.

2. Track the Relationship Between Sales, Variable Costs, and Profits

As you track your contribution margin, you should also be looking at side-by-side charts that include your sales and gross profits. This can help you better identify trends in the relationship between these metrics. With the ultimate goal of increasing your gross profit margin, you should evaluate how variable costs affect sales and profits to determine whether any changes should be made to your operations to reduce the overall cost of production or delivery of services.

Read More: Cost Analysis: Outsourcing vs. In-House Accounting for Your Business

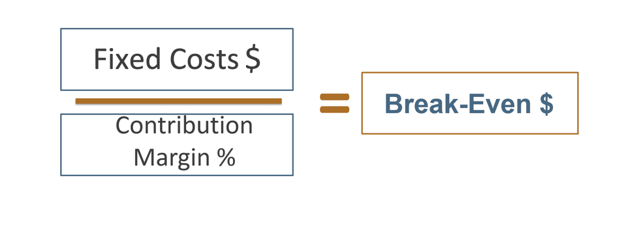

3. Calculate Your Break-Even PointThe point at which your profits are equal to your costs is called the break-even point. This metric is essential to a business's bear-bones survival, and you can't calculate it without first knowing your contribution margin.

The formula for calculating your break-even point is:

- Break-Even Point = Fixed Costs / Contribution Margin

4. Optimize Prices

In a cost-based pricing model, the contribution margin can help you determine your true production costs. When you understand your contribution margin, you can then determine how much money you need leftover on a sale to cover your overhead expenses and generate an appropriate rate of profit that can be reinvested in your company.

Pricing is the most challenging decision a business owner will make–

Are you confident in your pricing strategy? There’s a right and a wrong way to do pricing 👉This guide outlines how to do it the right way.

5. Evaluate the Profitability of Various Revenue Channels

Using unit economics, you can measure the contribution margins of various revenue channels in your business. This is a simple method of evaluating the profitability of each product or service you offer.

In order for a revenue channel to be profitable, the revenue that remains after variable costs must be greater than your company's fixed costs. Determining how much greater the remaining revenue is reveals the degree to which each revenue channel is profitable.

6. Invest in Revenue Channels With High Contribution Margins

Revenue channels with higher contribution margins are powerful profit drivers in your company. Once you've identified them using unit economics, you can focus your business on growing these revenue channels. For example, you could direct a greater portion of your sales team to focus on these channels or you could use a greater portion of your advertising budget for promoting these services or products.

(Keep in mind that allocating more people or variable advertising costs to these products can result in a shrinking contribution margin if these strategies are not applied effectively or efficiently.)

7. Identify the Best Variable Costs to Reduce

Measuring and tracking the contribution margin on individual revenue channels helps you identify high-performing revenue channels. It also helps you identify the low performers. In these cases, you can evaluate whether or not there are any strategies to reduce variable costs or whether these revenue channels should be cut entirely.

Read More: Fuel Business Growth With Outsourced Accounting in 2023

8. Measure How Operational Changes Affect Variable Costs

You can use contribution margin to test and evaluate changes, especially in direct labor costs (the biggest expense in most service-based businesses), that arise as a result of adjustments to your incentive programs and operational procedures in addition to the introduction to new tools and technology designed to improve workflow and increase efficiency. As your operations become increasingly efficient, you should start to see your contribution margin widen in the services or departments affected by the changes you make.

Improving Your Financial Leadership With Outsourced Accounting

Calculating and tracking metrics like contribution margin can seem daunting if your business does not have a robust back office designed to support these kinds of financial management processes. By investing in a reputable outsourced accounting service provider, your small or medium-sized business can afford the team, tools, and technology that can empower you to lead your company from the back office. With a powerful back office, you'll have reliable, timely financial reports available at all times to help you make sound, data-driven decisions to bolster your company's financial health and success.

.png?width=563&height=144&name=New%20GF%20Logo%20(37).png)