8 min read

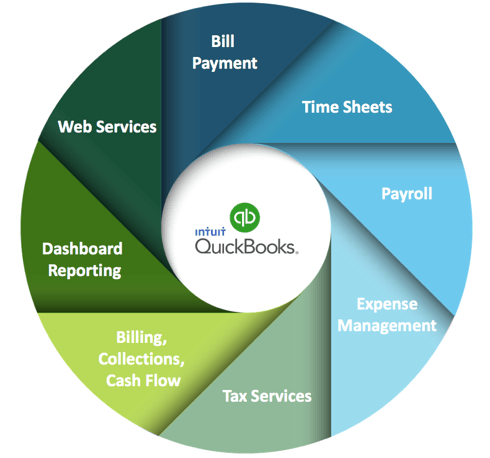

If you’ve ever had to research apps that work with QuickBooks®, you may have found the selection of titles overwhelming. Intuit, the maker of QuickBooks, has a searchable database listing literally thousands of software applications that integrate with QuickBooks Desktop (QBD) and QuickBooks Online (QBO).

|

Key Takeaways

|

With so many options to choose from, it’s hard for a small business owner to know where to start. As Intuit Certified Pro Advisors, we continually research and test drive QuickBooks applications.

In turn, we have identified through trial (and error) the best apps to optimize a small business ecosystem - the set of products and services that help small business owners with every aspect of running the finances and administration of their company.

To help you cut through the software clutter, we have created our recommendations of the best QuickBooks® applications currently on the market, particularly suitable for service businesses and nonprofits.

In addition to synchronizing well with QuickBooks, the apps we chose were required to supply users with the characteristics of:

1. Peace of mind

2. Operational efficiency

3. Financial intelligence

3 QuickBooks Apps You Need In Your Business

#1 Bill Payment Management

At GrowthForce, we are obsessed with Bill.com and recommend it highly to our small business clients. Imagine bill paying without hard-copy invoices or paper checks – that’s Bill.com

By transitioning to Bill.com, companies go paper-free, reducing the billing practice from a 13-step repeating process to a four-step process – saving significant time and labor costs. (Bill.com also recently acquired invoice2go, an all-in-one tool that helps you run your small business!)

With Bill.com, a company’s bills are emailed or scanned by its vendors and sent electronically to an inbox, entered, coded and routed for approval.

In turn, the manager with check authorization reviews and pays vendors’ bills electronically with a click of a button on a computer or mobile device. Once approved, the transaction is automatically entered into QuickBooks.

With QuickBooks Online, there is a two-way sync. In other words, changes made in Bill.com are made simultaneously in QBO and vice versa.

With QuickBooks Desktop, there is a separate Bill.com sync tool that pushes the transactions just one direction from Bill.com into QBD.

During the accounts payable process, Bill.com imports four pieces of information into QuickBooks:

1. Vendor’s name

2. Bill

3. Payment

4. Funds transfer amount

Only one total withdrawal is made from the business’s bank account each day. Bill.com also has a superior job costing functionality that can be activated when paying bills inside of Bill.com or inside of QuickBooks.

On top of all that, Bill.com is affordable: currently a modest $10 a month plus 99 cents per payment (by either electronic check or mobile merchant service).

Read More: Why We Love Bill.com for SMBs and Why You Will Too

#2 Time Management

To build a highly-profitable business, service businesses that make money on other peoples’ time must have a time-tracking system that is integrated with payroll, scheduling and leave management.

Service businesses need this integration to be able to perform true job costing, optimize their pricing and, ultimately, make more money.

We prefer the TSheets time-tracking app, because it’s so easy to administer.

Here are some of its most important features:

- Records employee time via a start/stop button on a mobile phone, iPad or computer

- Simplifies payroll by eliminating manual timesheets and duplicate data entry

- Uses GPS tracking to find clocked-in employee closest to the job assignment

- Alerts employees about schedule changes via text, email or push notifications

- Synchronizes timesheets to QuickBooks with one click, allowing for labor allocation and job costing

In addition, TSheets helps deter employee fraud. We once had a client who said, "I would love to put a GPS chip in the back of my guys, so I can know if they're really on the job site." We surprised him by saying,

"Guess what? We can do that with TSheets.” With GPS location services on an iPhone, TSheets can be set up to automatically start the time clock when employees show up at a job.

Either QuickBooks Desktop or QuickBooks Online can synchronize TSheets time entries with a business’s customer and vendor list, service items and employee roster. Once employee time is in QuickBooks, a business can use the time reporting to issue invoices and to allocate labor against jobs.

Another great feature of TSheets is reminder notices. TSheets will send staff an email at the end of the day that says, "Your timesheets are due." Employees click on the email link, view their job lists and fill out their timesheets in a couple of minutes.

If the employee ignores the request, the supervisor gets an email that says, "Charlie didn't submit his timesheets.” If you require timesheets daily, there's no better way to enforce that policy than the manager asking the next morning, "Charlie, how come you didn't do your time sheets yesterday?"

This ability to keep tabs on your employees is one of the reasons TSheets is the best time management system to use with QuickBooks. TSheets has all right tools in place to allow you to bill clients quickly and keep cash flowing into your business.

Read More: Being a Leader vs. Being a Manager: Level Up Your Managing Skills

Because your people are expensive, they make them your MOST important asset.

Are You Measuring How Your People Drive Profit?

Get The One Page Scorecard [GUIDE] .

#3 Expense Management

For expense management, we believe Expensify is the best application to automate expense reports and integrate them with QuickBooks.

With Expensify’s SmartScan feature, employees take a photo of their receipt on their phone. Then Expensify will code and report the expense before finally auto-submitting it for approval and uploading it to the QuickBooks’ general ledger.

With such an efficient system, there’s no longer any reason a company should deal with manual spreadsheet expense reports. Expensify expense management includes the following benefits:

- Saves time and money by not having to create and authorize manual spreadsheets, speeding up the approval process and eliminating duplicate data entry

- Increases accurate, timely financial intelligence by allowing job costing via mobile phone

enabled expense reports - Reduces the risk of fraud by requiring two authorized electronic approvals along

with payer approval inside of Expensify

Expensify touts that its system is 83 percent quicker than employees filling out manual expense report spreadsheets. One way Expensify saves time is by having the ability to memorize your company’s unique expense management policies and automatically determine which expenses actually need a manager’s review and which can get automatic approval.

Another time saving feature is Expensify’s rapid reimbursement system. As soon as reports are fully approved, the money is electronically transferred into the employee's bank account the next day. That’s an incentive for employees to fill out their expense reports when they're sitting in the car outside the restaurant or waiting for a flight at the airport.

When expense reports are submitted quicker, that means clients can be billed quicker and cash can flow into the business sooner. Employees are also less likely to forget to bill expenses when they fill out their reports soon after expenses are incurred.

Let’s look at a scenario of what can happen when expenses aren’t submitted on time – via the standard spreadsheet method.

Once business expense receipts are gathered, the employee enters them into an Excel spreadsheet and leaves the expense report on the supervisor's desk. When she see it she says, "I don't know why he spent $35 on supplies.

Let me talk to Joe about that." It takes two weeks for that talk and, finally 45 days later, the expense report makes it into the accounting department which says, "We've already sent the client the final bill. What do you mean you've got $1,200 airfare?" Often, the company might have to “eat” the expense.

By automating the expense management process so that and employees are actually coding the bill, you're going to get the expenses into the very next invoice to the client. When you do that, you ensure that the client pays expenses incurred against the account and your business gets paid sooner – resulting in a healthy cash flow.

Read More: Why We Love Expensify and Why It's Great for SMBs

Set Your Back Office Up As A Platform For Growth With Outsourced Accounting

Outsourced accounting is a smart way to streamline your business operations and save time and money. By using apps that work well with QuickBooks, you can automate and simplify tasks such as bill payment, time tracking, expense management, and payroll. These apps can also provide you with valuable insights into your business performance and profitability. If you need any help with setting up or using these apps, or if you want to learn more about the benefits of outsourced accounting, please contact us today. We are here to help you grow your business with confidence.