7 min read

.jpeg?width=682&height=455&name=AdobeStock_83358698%20(1).jpeg)

The primary reason people start businesses is to make money.

|

Key Takeaways

|

Yes, business owners want to provide better services and better products that solve problems for their customers, but behind all of those goals, the purpose of any business is to generate profits. Without them, you can't grow the business, you can't achieve the business's goals, your future vision of the business won't become a reality, and your company won't be successful.

This means that any individual in a leadership position in the business world should be focused on one thing: driving profits.

Why Driving Profits Is So Important Now

In business, focusing on financial management for profits is always important. Right now, however, profits are becoming increasingly important due to uncertainty in the economy. Employee turnover of the Great Resignation remains high, inflation is high, unemployment is on the rise, and the likelihood that we are about to enter an economic recession becomes greater every day.

During a recession – especially one marked by high inflation – businesses face a variety of challenges including decreased demand and increased expenses. As a result, revenue drops off and profit margins shrink, resulting in significantly decreased profits.

So, as you face a likely economic recession, now is the time to begin thinking about strategies for driving profits in your business.

Sign Up Today! Learn how to grow your profits even in the toughest economic conditions.

The Only Three Ways to Increase Your Business's Profits

1. Increase Revenue

On its own, revenue does not automatically equal profits. However, paired with robust profit margins, increased revenue does indeed translate to increased profit. As long as you are generating healthy profit margins on each sale, then the more you sell the more money you make.

You can increase revenue by expanding your client base, upselling existing clients, and generally placing an increased emphasis on sales. Of course, it is necessary to target the types of customers and jobs that are most profitable for your business (i.e. the categories of clients that tend to deliver the strongest profit margins for your company).

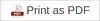

Another way is by price increases.

You can increase profit margins by raising your prices and/or decreasing deliverables. You can increase your fees to reflect the true value and scope of the services you offer. Use bottom-up pricing to base your prices on the profit margins you wish to generate. For example, instead of evaluating your costs first and then adding a markup, start with the amount of profit you want to generate on a sale. So, if you wish to make $20,000 in profits, then add $20,000 to your allocated overhead costs and direct costs to determine your price. This is the proper way to build profits into your prices.

On the other hand, if your prices are too low, but your customers cannot afford to pay more, then you can consider reducing the scope of what you offer at the original price point to lower your costs and produce the necessary profit margins.

A small change in prices can have a PROFOUND impact on your bottom line.

2. Increase Gross Profit %

The fastest (and most efficient) way to increase profits.

Gross profit % is the amount of revenue left over after all costs have been paid, expressed as a percent or rate. In any well-managed company, it's generally true that larger profit margins result in healthier business finances. The range of margins that are considered healthy varies from industry to industry, but it's always best to strive for the biggest profit margin you can achieve without pricing your business out of the market or operating so leanly that your product or service suffers as a result.

We recommend starting to improve your profit margins by uncovering time leakage (also known as SCOPE creep).

Here’s how to get started:

Maximized Productivity

The most expensive resource in your business is also the most finite: time. How much time is dedicated to each client, job, or service? How much time leaks away in between tasks or is wasted due to inefficient processes or ineffective meetings?

Take a close look at the way time is used, tracked, and billed within your company to minimize time leakage and maximize productivity so that you can also maximize ROI on labor costs.

Profit Drivers

Carefully track employee time so that you can accurately calculate direct labor costs and allocate overhead expenses to projects, clients, or individual jobs. This practice is called unit economics, and it allows you to pull profit and loss statements by category (individual job, client, or project or by job, client, or project type).

This makes it possible to understand your true costs and calculate profit margins on every project you complete and every client you serve. As a result, you can identify which are your most profitable, which are only a little profitable, and which are costing your business money. You can then focus your attention and efforts on the jobs, projects, and clients that generate the strongest profits for your business and stop putting resources into those that are actually costing you money.

By redirecting resources away from underperforming revenue channels into high-performing revenue channels, you'll increase your business's profits two-fold by making the most of the money you save.

3. Lower Overhead Expenses

While inflated direct costs can eat away at your profit margins, overhead expenses can take a major toll on profits, too.

The question becomes: how do you increase revenue without increasing overhead?

Start by turning as much of your overhead costs from fixed expenses to variable expenses.

In service businesses, labor is your biggest expense (fully loaded labor costs are usually 70-80% of the expenses).

Because of that, you need to keep a close eye on your company's growth trends and hiring needs. If you're growing, then you'll need to determine the right time to hire new employees. You want to hire early enough that an employee is onboarded, trained, and ready to go as soon as you need them. Hire too early, however, and you'll be paying for labor you don't yet need. Hire too late, and productivity will lag as a result.

You can also look at ways to restructure your operations in order to lower overhead costs through outsourcing.

Arguably the most effective way is to outsource non-core business functions. This can save your company big time in terms of payroll, employee benefits costs, office costs, supply costs, and more.

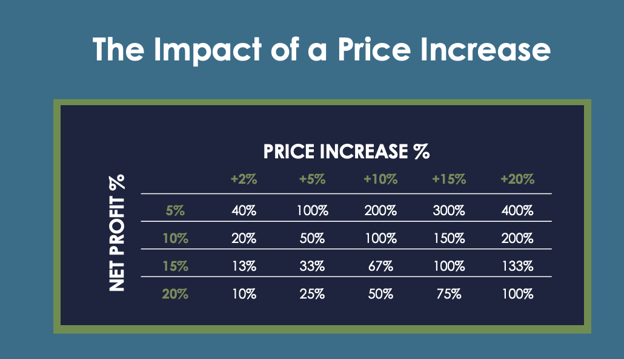

The world of outsourcing is changing- and at a rapid pace. In Deloitte’s annual Outsourcing study that looks at the drivers behind outsourcing, while cutting costs ranks within the top five primary drivers, it is overshadowed by:

- Business and operating model shifts

- Increasing cyber security threats

- Gaining access to new capabilities

- Increase pace of technology

People are now looking at outsourcing as a strategic initiative to get access to an expert talent pool and stay ahead of trends- all while at a lower cost.

Cut Costs and Identify More Profit-Driving Strategies by Outsourcing SMB Accounting

In addition to reducing overhead costs, outsourcing your bookkeeping and accounting department to experienced professionals can help you maximize profits and improve the overall operations of your business.

A well-run back office provides financial insights that will not only help you identify and maximize your profit drivers but can also save you money by improving your operations, business strategy, and financial foresight. A robust back office can help you strengthen your company to survive and thrive during tough economic times and prepare your company to seize opportunities as they arise.

.png?width=563&height=144&name=New%20GF%20Logo%20(37).png)