Are you facing some hard decisions about where to make cuts in your business? Here's how to figure it out…

During a crisis, the most difficult decision a business owner has to make is: where do I have to make cuts?

The is not the time to act only on your gut. Emotions are heightened, and businesses that make decisions based on the numbers are better able to keep their doors open during a crisis.

Knowing your break even point will help change the way you run your company.

We recommend you figure out your break even in three cases: the best case, the mid case, and worst.

This is a simple financial calculation that helps you stress test your business model and see how much you can afford to take a hit on lost revenue, and how much cuts you need to make.

Scenario Planning (in a crisis)

In each scenario, you want to figure out two different assumptions.

- Timeline. How long will this last?

- The percent % of revenue affected. How much revenue (as a percentage) do you think you going to lose?

- What does the three cases look like?

Best Case

Mid Case

Worst Case

Time Horizon

2-3 mos

6-9 mos

1 year +

% Lost revenue

10%

20%

40%

Put a model together that helps you put the reality behind your numbers.

Every business’s scenario will look different. Your answers will depend on the the following factors:

- The industry you are in– the crisis effects each industry differently.

- The region you are in– different guidelines for different parts of the country.

Once you have a sense of your three different scenarios, we then suggest you calculate your break-even point at each point.

What is my break even point?

Break even is a management accounting point at which your total revenue and your cost are equal (i.e. there is no net loss or gain)

If you are losing money, calculating your break even will tell you how much you have to cut. You need to know that number for each of your different scenarios. Based on how things play out financially, this will tell you if you should prepare to dip into your reserves or not.

The calculation itself is very simple…

Your Fixed Costs

The dollars that do not change if you add a new client. It's overhead : the cost of your rent, your management salaries, and contracts you're locked into for HR, IT and Accounting

----------------------------------------- DIVIDED BY----------------------------------------------

Your Contribution Margin Percentage

Your contribution margin is your gross profit margin minus any variable overhead expenses (e.g. sale commissions). This is the amount each client “contributes” to pay for overhead and generate a profit. It's the percentage of money that you earn on the work that you do

What does the Break Even point tell you? This will tell you how many dollars you need to bring in order to “cover your nut” and not have to tap into your reserve funds.

The bigger picture: Why do I need A break even analysis?

Break even calculations are a pivotal component in scenario planning.

A break even analysis creates a clear snapshot of your financials and helps you see how much revenue you need to bring in to not dip into reserves. With this information, you will know how much additional revenue, increased margins or fixed cost cuts you need to make.

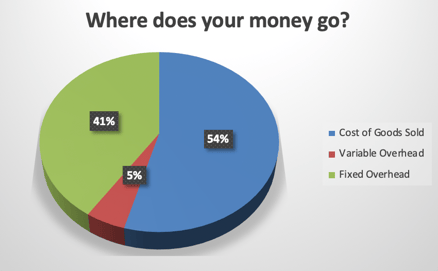

Here's an example from our Break Even Analysis tool.

You should be able to see how much more revenue or increase in margins you need to find. Right now it may be easier to figure out how much you need to cut in order to be able to pay yourself.

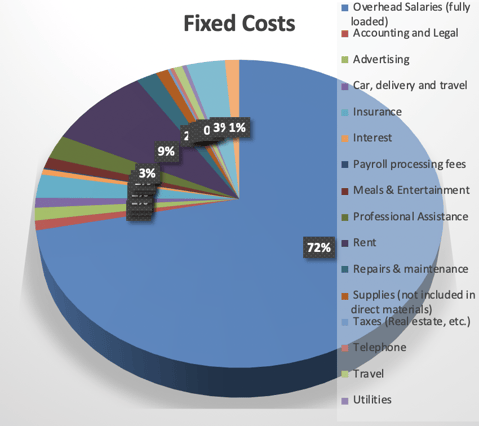

A break even analysis gives a snapshot of your fixed costs. This is the first area you will want to make cuts. Why? Because these costs are not directly making you any income. These are your indirect cost and not your core competency (see image below) ...

Look at each of these categories separately with a fine tooth comb to see how you can get those costs as low as possible.

4 More benefits: How else can this help my business?

A break even analysis is the simplest way to determine a number of factors relative to your company’s future success.

Pricing Strategies: Your break-even point allows you to finalize long-term pricing strategies. Armed with your break-even point, you'll be able to modify your pricing model accordingly to ensure you're not only only breaking even, but you're making a profit . Knowing how much is needed to sell to break even, at what profit margin percentage %, a business can adjust its pricing strategy to meet their goal.

Projection Strategies: A break even analysis will allow you to take into account projected market fluctuations so you're better prepared if your industry is expected to experience ebbs and flows. You want to be proactive- a break even analysis will give you the knowledge you need, so you can make positive decisions before you're hit with unexpected downturns

Sales Strategies: You won’t know how much you need to increase sales if you don't know when you're breaking even. A break-even analysis will help determine the volume of sales you need to break even. This helps companies figure out a realistic goal for their sales team and how much you need to sell to be profitable.

Cutting Costs: Break even will also tell you where you need to reduce expenses and cut costs. For example, maybe you need to scale back on hourly labor or reduce the number of machines you're running at certain times. A break even analysis separates the indirect/below the line costs. These below the line cuts should be the first to go because they don't help you generate income. Eliminate nonessential expenses as much as possible. Consider outsourcing to convert a fixed cost in the back office to a variable cost, that goes down as your needs contract.

Ask us about how we help clients do a break-even analysis and how we can help you too! Click Here ---> Advisory Services

![5 Steps To Power Through 2021 How Smart Business Owners Get Stronger In A Recession [WEBINAR] Sign Up!](https://no-cache.hubspot.com/cta/default/549461/fcba028d-f3ee-4ae0-ae8a-d3eeb774803c.png)