.jpeg?width=900&height=585&name=AdobeStock_228709871%20(1).jpeg)

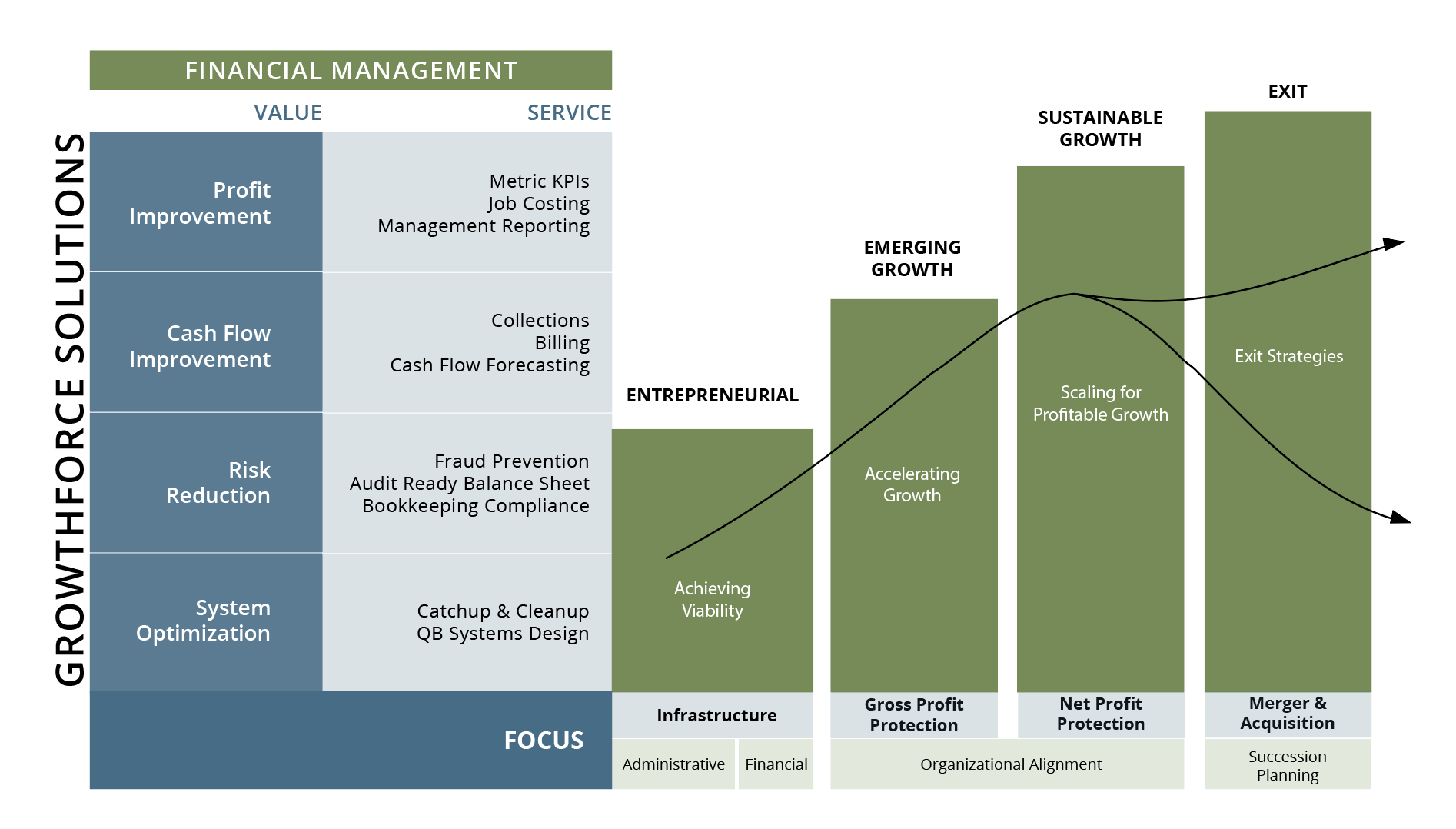

All businesses evolve through a series of common lifecycle stages, beginning with the entrepreneurial phase, moving through a series of growth stages and finally entering maturity and exit. Like a living, breathing and ever-changing organism, a business's different needs and requirements depend on its current lifecycle stage.

With foresight, ingenuity and the right assistance, business owners can establish scalable, customizable back offices that will be equipped to provide everything the business needs to evolve and grow, as it is needed. Be successful from the start: Build a solid financial foundation.

How a Scalable Back Office Accelerated One Company from Start-Up to 8-Figures

One of our longstanding clients, started a marketing firm from the ground up. At the beginning, he was the only employee. He was responsible for every function of his business, handling customer acquisitions, sales, client services and all of the company's bookkeeping and accounting.

Entrepreneurial Phase

In the first phase of any new business, minimizing costs is essential, but it is also important to build a strong foundation. During these first months or years of business, you create the bones of your operation, systems, infrastructure and processes. Establishing sound procedures at a minimal cost is essential to success.

During the early days of his business, our client realized that he needed assistance with his bookkeeping and accounting functions. Not only did he need to minimize expenses, he also needed to appear professional to his clients. GrowthForce was able to help him establish a sound back office infrastructure.

Initially, the services this client required were minimal. He brought us in to set up his QuickBooks system, and we taught him how to use it to record costs, track classes, pay bills and invoice clients.

Soon, our client's financial dealings appeared professional and credible, making his business look bigger than it actually was. This also enabled him to establish a scalable infrastructure in his back office from which he would be able to seamlessly grow the business.

Emerging Growth Phase

The next phase of a business occurs once the company begins to see real traction. With new growth comes new challenges, such as hiring, training and paying employees, managing customer acquisition costs and anticipating your business's needs before they become necessary.

During the growth phase, proactive cash flow management and forecasting are essential to avoiding business failure. Cash flow problems are the number one reason new businesses fail. The faster a business grows, the more working capital it needs to survive.

During his marketing company's emerging growth phase, our client needed an employee to handle all of the company's bookkeeping. He first approached his CPA who was filing his taxes. These types of accounting firms, however, do not specialize in client accounting services. Although they have bookkeepers on staff, they are not equipped to continue providing full services through tax season, nor can they offer built-in risk-mitigation. Having only one person available to handle all of the company's bookkeeping functions created no system of checks and balances, exposing the company to risk of fraud.

As a result, the business owner decided to add new services from GrowthForce, provided by a complete financial team at a fraction of the cost. To lighten his burden and improve the back office function, this business owner seamlessly added billing, collections, bill payment, expense management and cash flow forecasting services to optimize cash flow and address problems before they occurred.

In addition, he became more concerned with protecting his gross profits. We helped him track how much the company made on each job to identify whether or not any value in the transaction was given away for free or if any costs were not anticipated prior to pricing. By tracking value, costs and time on every job, client or task, we helped our client improve pricing.

Sustainable Growth and Maturity

When a business reaches sustainable growth or maturity, it needs a more extensive back office infrastructure. A company in this stage requires management reporting to provide actionable financial data, which can be used to continue optimizing operations, to further drive growth or to identify new areas of opportunity.

In addition to meeting this company's needs as they developed its scalable back office, the same accounting system now allows this marketing firm to pull reports from over nine years of data. That means they have access to nine years of unit economics from which they can generate management reports that provide their managers with actionable data.

Thanks to the foresight of this marketing company's owner, the business's smart back office was able to scale its infrastructure to meet the demands of each new growth stage. Even though we provided only limited services in the beginning, to free up the business owner's time, the back office infrastructure had a strong foundation and structure which made it easily scalable at each stage of the business.

This company, which began with one person and his vision, now brings in eight-figures of business annually and has a management team located across the United States.

Be Successful from the Start: Build a Solid Financial Foundation

During the early stages, many business owners make the mistake of thinking they can and should handle the entire back office function in order to maximize dollars put toward growing the business. Spending a little money to establish a solid financial foundation, however, is essential to building a successful company.

From the start, you should have smart systems in place that will help you anticipate future problems, plan for future growth and which will continue to function and meet your business's needs for the long-haul.

Although your back office's requirements at the beginning might be minimal, be sure to bring in professional assistance to help you establish a smart QuickBooks system and learn how to use it properly. With the right know-how and expertise available to you, you will have the power of a smart back office to drive your business's growth.

At GrowthForce, we tailor our services to meet each of our client's unique set of needs. We provide a customizable and scalable menu of outsourced bookkeeping and accounting services. At a fraction of the cost of hiring a full-time employee, businesses of all sizes can access the services, people and expertise they need, when they need it. Our scalable services help business owners by:

- establishing professional bookkeeping and accounting systems and providing training to new business owners

- assisting with day to day bookkeeping functions such as bill payment, bank account reconciliation, collections and billing/invoicing

- boosting finances with cash flow improvement, cash flow forecasting, price optimization and unit economics

- providing risk and fraud mitigation with a fully dedicated team which includes a bookkeeper, accountant and accounting manager

- assisting with strategic planning and data-driven decisions with management accounting and management reporting

A strong back office and financial foundation will put your business ahead from the start. With an intelligent infrastructure already built into your business model and operations, you will be able to make smart business decisions, with the ability to scale your back office to meet your business's changing needs throughout every stage of growth and well into maturity.

Get a scalable smart back office for your business!

Schedule a call today to learn how it works!

.png?width=563&height=144&name=New%20GF%20Logo%20(37).png)