If the goal of invoicing for your services is to get paid, then it makes sense to simplify and standardize your billing process. More importantly, you need to optimize your method for how you get paid. A simple review of your current billing process can uncover ways for you to improve cash flow by getting paid on time and more frequently.

A more frequent and effective billing process has the potential to improve your cash flow by aligning clients' payments for services with your service-related expenses.

Here are 4 options to improve your billing process:

1. Get a Deposit Upfront Before Work Begins

Get 50% upfront on every job and you will immediately change from a mindset of scarcity to one of abundance. Why? Because, since many jobs target 50% gross profit percentage, you will have covered all your costs at the start of the job.

If you manage the job right, you don’t have to worry about getting the next check to make payroll.

There’s a big difference between 33% and 50% - Shoot for 50% if you can.Deposits are intended to cover your costs, so you minimize your risks.

Remember: A deposit upfront ensures trust and relieves some of the risks of non-payment. You need to establish trust with the prospect to get money upfront.

2. Bill Weekly Instead of Monthly

How often do you send out invoices? Many businesses only invoice clients at the end of the month. Why? It’s always been that way. There’s a flaw in that process.

Billing weekly can significantly improve the timing of payments.

If you have the staff that are able to invoice weekly you’ll have a major improvement in cash flow over monthly billing.

According to Vistr, if you issue invoices on the same day each week, the data suggests you should send invoices on the weekends to get paid faster.

3. Bill Immediately at Project Completion

If you finish a job on the fifth of the month but you don’t send out the invoice until the end of the month, and the client pays you 30 days later, you’re not going to get paid for 55 days. You probably have payroll at least three - four times during those 55 days.

You should invoice the client as soon as possible, weekly, at milestones, or as soon as the job is done. As soon as you finish a job, bill the client. This invoice template by KeeperTax can help you create an invoice fast.

Send the invoice the same or next day if you want to get your money faster. If you have service people working in the field, get them a Square™ account so you can get paid before they leave the job site.

If you focus on getting your money faster, you’ll be well on your way to improving your cash flow.

28 Ways To Gain Efficiency and Peace of Mind Using Best Practices of Cash Flow Management

28 Ways To Gain Efficiency and Peace of Mind Using Best Practices of Cash Flow Management

4. Bill Milestones, If You Can't Bill Weekly

When retainer or weekly billing won’t work for you, milestone billing is the next best way to help stay cash flow-positive throughout the course of a large project.

Timing and the amount of the payments should be based upon something material you could point to.

The payment schedule should allow you to stay cash flow positive as you move through each stage of the job. This is the key to give you enough working capital to keep investing in the next phase of the project (e.g. planning, design, development and implementation).

Start with a mindset that you need to stay ahead of your out-of-pocket costs. That means getting 50% upfront and get the other 50% front loaded into major milestones.

The goal is to leave the smallest percentage for the final payment when most of the problems arise.

» "Fundbox‘s own research shows that 64% of small businesses are affected by late payments."

Get Cash Before Payroll

In the ideal world, you get cash from your customers on a project before having to pay payroll related to that project. That’s the holy grail of cash management — but it's not always possible in every industry and business model.

But you can shrink the time between when you get paid and when you have to pay payroll. This has a material impact on cash flow. The bigger and more successful you are, the more important that becomes. Why? Bigger companies need more cash to survive and the cash flow risks are greater.

Whether you're a $500,000 company or a $5 million company, you have to make every payroll. A big reason why so many small businesses fail, is because they spend their time chasing cash just so they can make the next payroll.

“Here is the best part about cash flow maximization strategies of reducing expenses, reducing receivable days, reducing inventory days, or increasing payable days: Very small changes can have enormous ramifications on your cash flow.”

- Cunningham, Keith J. (2012). The Ultimate Blueprint for an Insanely Successful Business

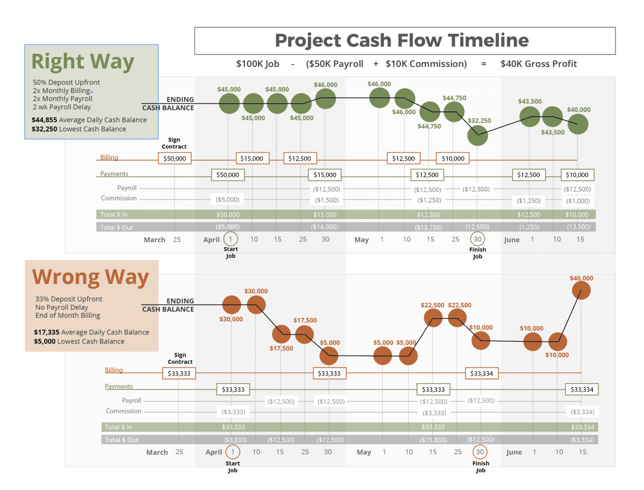

Project Cash Flow Timeline Example

Here is an example of the impact on cash flow just by changing two business practices:

By getting a larger deposit upfront and delaying payroll two weeks, you can more than double your average cash balance. If you did that on every job, it's huge for a small business!