Where should a small business owner turn to determine whether to fire a client, when to expand the sales force or how to price a proposal?

To make these types of decisions, a business owner must be able to forecast and measure the potential profitability of the decision. An owner/CEO cannot project profits by simply studying the income statement and the balance sheet – that’s financial accounting, looking at historical performance.

To predict the impact of a business decision on future performance, a business owner must rely on management accounting.

Management Accounting

Management accounting is internal accounting which helps business owners put their numbers to work to make data-driven business decisions. The accounting discipline uses unit economics, breaking down a business to its most basic unit, to understand profitability and measure success.

For a service business, where people are the product, that unit is employees. In this case, management accounting is accounting for the cost of your people. It's having visibility into the true cost of your employee’s work to ensure that when you're putting a price on a proposal, you can make the most money you can on that job.

True Job Costing

The most important decision that you, as a small business owner, will ever make is how to price jobs and services. The job costing process tracks the true costs to deliver a service or job, so a business can charge the right price to achieve its target gross profit margin.

Service businesses, where employees’ work is the product, can benefit the most from job costing because they have these characteristics:

- Payroll is the biggest expense of the business.

- Time can easily be lost and services given away.

- They need access to real-time key performance indicators to make pricing decisions every day.

To understand the process of job costing, we first need to review a little Accounting 101.

Balance Sheet

A balance sheet is a snapshot of your business’s financial position at a point in time. On the other hand, an income statement is a like a video - the cumulative picture of your company over a period of time.

A balance sheet is comprised of your assets, liabilities and equities. Assets are what you own and consist of cash, receivables, office furniture, equipment, etc. Liabilities are what you owe and include accounts payable, taxes, bank debt and credit card bills.

When assets (what you own) are reduced by liabilities (what you owe) the result is equity, the net asset value of your company. By watching the total equity balance trend, a CEO can quickly assess if a business is growing in value.

Income Statement

To see what causes equity to change each month, an owner/CEO needs to review the income statement. This document reflects revenues or income minus expenses to show net profit or loss over a period of time, usually a month. Profits cause equity to increase; losses cause equity to decrease.

To understand the profitability of their businesses, many CEOs will only look at the income statement at the end of each month. Why? Because the income statement tells them what they want to see – their topline revenue and bottom line profit. But those lines on an income statement don’t show the whole picture of a business’s profitability. To see more detail, you must change the way you look at expenses on the income statement.

Expenses: Direct vs. Indirect

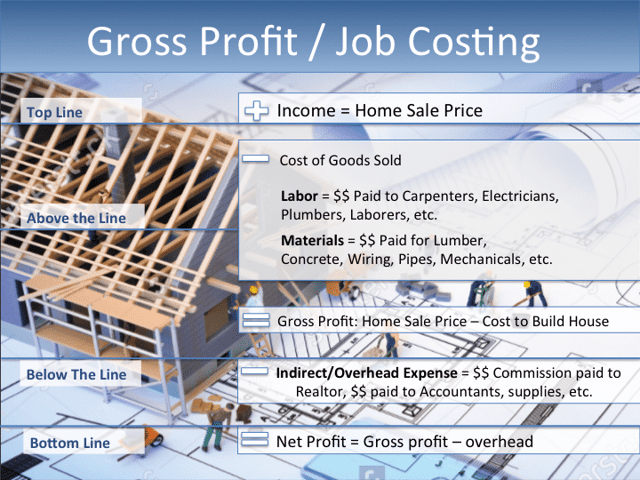

Direct expenses are the costs incurred working directly on a client’s job or project. Indirect expenses are overhead costs, expenses that are not directly related to generating income.

In QuickBooks, the expenses section on an income statement defaults to a list of expenses in alphabetical order. In order to job cost, the QuickBooks chart of accounts must be manually set up to separate direct expenses and indirect expenses.

Direct expenses are considered the cost of goods sold (COGS) on the chart of accounts. COGS is an important number in job costing because it’s used to calculate gross profit on a job.

Income or Revenue – COGS = Gross Profit

Only two types of costs make up COGS. They are direct labor and direct materials. For a service business, direct labor is the wages of the people who worked on a specific job. Direct materials are the bills and employee expenses attributable to the job.

Overhead Expenses

Overhead is the other expense category we still need to tackle. These are the expenditures that are necessary to run your business, but not directly attributable to a customer or job. Overhead costs are considered “below the gross profit line.” These costs are deducted from Gross Profit to calculate your net income.

There are four possible overhead departments or cost centers:

- Sales and marketing

- General and administrative

- Product or industry

- Management

Gross Profit

The best way to look at your business’s profitability is not to look at profits as a dollar amount, but as a percent of revenues. While your income may be growing, your gross profit could be shrinking, but you won’t recognize that fact unless you see the relationship between the two as a percentage.

(Gross Profit $ divided by Revenue $) X 100 = % Gross Profit Margin

Once you understand how to calculate the gross profit you understand the accounting behind job costing. You are now ready to set up the business systems that will quickly and easily provide you with the costs and expenses to allocate to jobs and projects.

Labor Cost Allocation

Job costing used to be a difficult task requiring a lot of manual effort to compile expenses. However, with QuickBooks and off-the-shelf business technology available today, businesses can easily determine gross profit on every job, customer, service item or employee.

QuickBooks makes job costing simple because it has a built in project accounting function (the pro in QuickBooks Pro stands for project) and an automated labor cost allocation feature.

The best run businesses use their accounting systems to track direct labor and expenses incurred to deliver services. To efficiently allocate labor costs, a company must automate and integrate its employee time tracking, expense management and payroll systems with its accounting system.

With this system integration, an employee can use a smartphone to can track the time spent on every job, customer, product or service, and automatically feed that information into the accounting system. The timesheet information will then be used to bill clients, generate payroll and automatically allocate labor costs, matching the labor to the revenue from a job.

Why Allocate Labor Costs?

Unless a business’s financial, time tracking and payroll systems are integrated, the business is likely to have time and expense leakage that will go undetected and unbilled.

When a project-based business loses sight of project management, travel time and other non-billable time, a business can often spend months not knowing they are underwater on a job or project. By the time the missed expenses are discovered, it’s too late to bill the client an additional fee.

Job costing works best when the practice is used to monitor and manage every expense that goes into conducting business. Even internal tasks, such as non-billable meetings, should be charged as a job, so you can scrutinize the cost of every business function.

Why Job Cost?

Job costing matters particularly for service businesses which must optimize their employees’ time because of business pressures such as:

- Limited skilled labor resources

- Increased competition for customers

- Less time to complete projects

- A need to anticipate market volatility

Through job costing, a business can identify its opportunities with the highest gross profit potential and steer its employees toward those big-rock opportunities. With customized job costing reports and clear gross profit goals, a small business owner can make data-driven decisions to answer a business’s most pressing questions.

- Are we running jobs on budget?

- Are we within our target margins?

- Who are the most profitable and least profitable clients?

- Which clients do we need to re-price? Or fire?

- Do we have operational inefficiencies?

- Who are the most productive people, employees, teams, and departments?

- When is the right time to hire more staff?

- Where should I invest my marketing dollars?

- Where should I focus our sales staff?

Get decision-ready financial information from GrowthForce

Here at GrowthForce, we go beyond just bookkeeping and accounting. GrowthForce helps businesses set up job costing procedures by automating time tracking, payroll and expense management systems and integrating them with QuickBooks accounting systems.

We provide critical oversight and account management to ensure that the right policies, procedures and systems are implemented to produce accurate financial and management reports. GrowthForce helps businesses run with total confidence backed by the dependable financial and management reporting that they need to make informed decisions to grow their businesses.

.png?width=2000&height=440&name=Transitional%20GF%20Logo%20-%20Transparent%20(1).png)