10 min read

If you're struggling to raise enough money, maintain a healthy cash flow, and end each year balanced or with a surplus, then you're not alone

|

Key Takeaways

|

Many nonprofit leaders struggle to make ends meet because nonprofit fundraising is rife with challenges. With very limited resources to operate and carry out fundraising efforts, unfortunately, throwing your fundraising resources against the nearest wall to what sticks, most likely, won't cut it.

Nonprofits need to be highly specific, targeted, intentional, and intelligent about the way they fundraise to stay afloat and able to continue carrying out their important missions.

With the right approach, you can fundraise successfully and run a financially stable and healthy nonprofit.

Boost Your Funding With These Top 10 Nonprofit Fundraising Best Practices

1. Focus on Building Relationships

Relationships foster donations more reliably than just asking. So, instead of spending a ton of money to ask an enormous group of anonymous people, focus on cultivating relationships with a smaller group of key potential and previous donors.

Giving USA's 2021 Annual Report on Philanthropy [1] cited nearly 80% of giving comes from individual donors, while only 15% comes from foundations and 5% comes from corporations.

When asking donors – especially, potentially large donors – for gifts, don't think of it as an "ask" but as a courtship, instead. It's incredibly important to build relationships with donors and continue to dedicate your time (or that of your board members) to them. Your donors need to know your organization, understand how dedicated you are, and be able to believe that you and your nonprofit can be trusted to use their money wisely.

2. Lead With Your Impact Before the Ask

Whether you're working on a mass marketing mailer campaign or you're returning to a few key donors, be prepared to communicate your organization's impact in a way that will be meaningful to your donors.

For example, you should be able to quantify their dollars in terms of impact by using phrases like $5 feeds a person for a day, $10 provides school supplies for one child's school year, $100 helps us deliver X number of meals, etc.

Quantifying your impact in this way helps better connect donors and their dollars to your cause. It enables them to see the real difference that their generosity can help you make in the community.

We call this data storytelling. It has proven to be one of the most effective ways to use data to create new decisions or actions. Data Storytelling is meant to explain the data and why it matters, through a powerful combination of communication, analysis, and design to create a "story". [2]

3. Motivate Your Nonprofit Board Members

The relationship between a nonprofit board and the executive director can be delicate and tricky. As an executive director, your board is comprised of volunteers, and they are in charge of you. However, it's essential that you help to manage the organization's expectations and requirements of board members in terms of fundraising efforts – and that expectation should be that they help out.

When you welcome a new board member, remember that their fundraising efforts need to be led by you. You should train them, coach them, and mobilize them. Also, be sure to provide them with a list of options of different fundraising jobs and responsibilities so that they can choose the activities that interest them most.

Not all board members are alike. Some of your board members will be introverts and others will be extroverts, and this makes them better suited to different types of fundraising responsibilities. Giving them the power to choose how they participate in fundraising will increase their interest and improve their self-motivation.

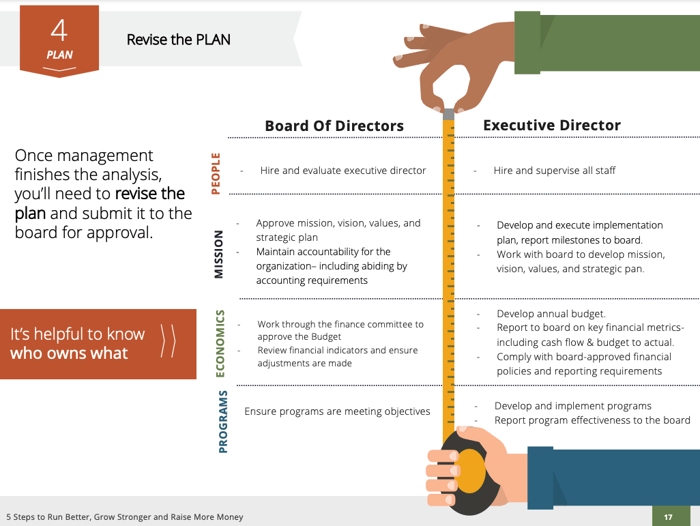

Board Of Directors Vs. Executive Directors Roles

It's helpful to know 'who owns what' when planning!

4. Identify and Focus on the Most Successful Nonprofit Fundraisers

This task will require you to have fairly robust bookkeeping and accounting capabilities that enable you to accurately track and categorize expenses and time. By doing this, however, you will be able to pull a profit and loss statement for every single fundraiser your organization does including events, social media campaigns, mailers, and more.

These profit and loss statements will enable you to see your actual return on investment in these fundraisers. You'll be able to identify whether any of them are actually losing you money in addition to determining which perform best. You can then drop the efforts that don't generate much return and focus your resources on the fundraisers that work best for you to effectively maximize your fundraising ROI.

5. Identify and Focus on Your Most Successful Programs

Like with fundraising, with the right bookkeeping and accounting procedures in place, you can pull profit and loss statements on your programs. With programs, you might look at a different return than you would on a fundraiser – not necessarily asking, "How much money did this program bring in?" but looking at, "How many people did this program serve and at what cost?"

This will allow you to rank your programs from most effective to least effective and most costly to least expensive. You can then rank stack your programs, prioritize them, and determine whether any should be cut so that those funds can be better allocated to a more effective program.

6. Examine Other Nonprofit Funding Models (or Adopt One)

The larger your organization grows, the more essential it will become for you to adopt and follow a general funding model in your nonprofit. A nonprofit funding model is a methodical, strategic set of procedures that outlines how your organization raises funds and where those funds come from. A funding model will help you create a reliable base of donors and other funding sources to support your mission. [3]

Some examples of various funding models include:

- Beneficiary Building - Commonly used by universities and other institutions, these nonprofits rely heavily on converting previous members into donors.

- Emotional Connectors - These organizations communicate their purpose and connect quickly and deeply to wide donor and volunteer bases comprised mostly of individuals.

- Member Supported - One of the most common member-supported types of nonprofits is churches. Most churches are run on the donations provided by those who attend and rely on the organization as a large, valuable part of their lives.

- Primary Donor - Some nonprofits run almost entirely on one or two large funding sources from foundations, grants, or individuals who are strongly moved by the cause.

- In-Kind Donations - Some nonprofits rely heavily on in-kind donations that they resell to fund a greater mission.

- Publicly Funded - Certain nonprofits provide social services on behalf of the government agencies that fund and, to a certain extent, oversee their operations.

Take a look at your nonprofit's fundraising strategy and primary funding sources to determine what type of funding model you're using. Next, research how you can better hone this methodology and improve your funding strategy to solidify a reliable funding base.

Read More: Successful Fundraising for NonProfits - Advice From An Expert

7. Make Each Dollar Count

Using methods similar to those you can use to evaluate profit and loss on programs and fundraisers, you can also assess the ROI of every dollar you spend in your nonprofit. With funds likely scarce and budgets tight, it's essential that you spend wisely. When building your budget each year, quarter, or month, rigorously scrutinize every single expense to cut unnecessary costs and ensure that you're spending your organization's funds in ways that will generate the greatest ROI.

8. Maximize the Use of Nonprofit Grants

Most funds from government and foundation grants have fairly rigid rules regarding how the dollars can be spent, and this usually means that the money must be used directly on programs.

Read More: Grant Tracking Problems And How To Fix Them

You can, however, use some of this money to cover a portion of your overhead (indirect) expenses if you accurately allocate these costs to programs in your organization. With well-documented time tracking and cost categorization, you can determine how much of your indirect costs were proportionately used for certain programs and then allocate that portion of those costs as "direct" expenses for that program.

Grant-giving continues to be on the rise. The numbers speak for themselves: Candid tracked $10.7 billion across 24,349 grants by foundations, corporations, and large individual donors in the U.S. the past year[4]

As a result, you'll more effectively use your grant money – never leaving a penny unspent and having to send back dollars that sat unused and ineffective in your nonprofit for the term of the grant.

9. Focus on Quality Donors – Not Necessarily Quantity of Donors

Like in for-profit businesses, nonprofits have to spend money to attract donors. These expenses are called customer acquisition costs (CACs), and it's an important metric to know and control in your nonprofit. In addition to keeping track of how much you spend to draw in new donors, you should also be paying attention to your donor retention rate (how many donors stick around to give again) and their lifetime value (how much a typical donor gives over the course of their relationship with your nonprofit).

Read More: What Nonprofits Can Learn From the Best Well-Run Businesses (and Vice Versa!)

Next, implement programs and procedures for improving your donor retention rates because the best (i.e. least expensive) donors are those that you've already acquired. One of the biggest parts of retaining donors is to make sure you thank every single one, every single time for their generosity. Remember cultivating relationships with existing donors is more important and effective than attracting new donors.

10. Know Your Nonprofit's Numbers

As an executive director, you can't fundraise effectively or successfully operate a nonprofit without access to timely and accurate financial data anytime you need it.

With up-to-date financial data at your fingertips, you'll be able to track the metrics that matter most to your organization, prioritize programs and fundraisers, and spend your money more smartly. In addition to boosting your funding streams, knowing your numbers will ensure you leverage that increases in funds in the smartest way possible, to maximize your ROI and your nonprofit's impact.

Make the Most of Your Nonprofit Funding With a Better Back Office Your Nonprofit Can Actually Afford

No matter what sort of nonprofit fundraising challenges your organization faces, you will struggle to jump the hurdles and improve your fundraising efforts if you don't have a strong back office with automated bookkeeping processes to help you stay ahead of your organization's finances.

At first glance, a robust bookkeeping and accounting department might not seem integral to your mission. It might even seem like it's too big of a spend. However, there's no other way to truly know and understand the ins, outs, and inner workings of your nonprofit without a solid back office to support the financial management of your nonprofit. Plus, outsourcing your back office will minimize the costs.

With a better back office, you'll have timely and accurate data at your fingertips that can allow you to identify your nonprofit's strengths and weaknesses, its most valuable donors, and its most profitable fundraisers. With a better back office, you can work smartly to increase your fundraising efforts and results while maximizing the ROI of each dollar spent, ensuring your organization remains operable while doing as much good as it possibly can.

[1] https://store.givingusa.org/products/2021-annual-report?variant=39329211613263

[2] https://venngage.com/blog/data-storytelling/.

[3] https://ssir.org/articles/entry/ten_nonprofit_funding_models

[4] https://www.ncrp.org/2021/02/covid-19-philanthropy-and-4-big-questions-for-2021.html

.png?width=563&height=144&name=New%20GF%20Logo%20(37).png)