5 min read

Being a leader in business is challenging enough already, let alone trying to navigate through a crisis. Having to make tough decisions gets even harder when the economy drops into a recession and anxiety sets in. Let’s review the current situation, the biggest mistakes we’ve seen and what to do instead.

|

Key Takeaways

|

According to the Bureau of Labor Statistics, unemployment rates [1] in December 2020 were at 6.7% with 10.7 million Americans unemployed. That's nearly twice the unemployment rates recorded before the start of the pandemic in February 2020.

With the struggle faced by businesses ordered to close or operate at limited capacity compounded by lockdowns, quarantines, and work-from-home adjustments (not to mention the supply chain disruptions occurring around the world), the novel Coronavirus has done more than throw the world into a health crisis; it's also leading us into what could potentially be the biggest economic recession we've seen since 2008.

With the last recession having occurred relatively recently, many business leaders will enter the next, great economic challenge with first-hand experience under their belts. Others with less experience will have to face the same challenges.

Whether you've been through a recession in a leadership position before or the next economic crisis will be your first, here’s how to avoid some of the biggest mistakes and find out what you could do instead to successfully navigate and survive a recession...

10 Biggest Mistakes CEOs Make During Recessions

1. Panicking

Panic clouds logic and reason with anxiety, inhibiting your ability to think clearly and make rational decisions. Panic is also a sign of reactive, rather than proactive, management.

When the next recession hits or your business faces its next inevitable challenge, take a deep breath, stay calm, and take control. Don't just start laying off people. Taking control means using your resources to make smarter decisions. When it comes to financial decisions, make sure you have accurate and actionable insights at your fingertips. Talk to trusted sources for advice in areas of your business most affected.

If you're really concerned, call us and we'll talk about what you could.

2. Delaying Essential Hires

When an employee moves on from your business during a recession, you might be tempted to delay their replacement to cut overhead costs temporarily. But first- remember employees are your biggest asset. Consider the impact an employee's absence and the unfilled position will have on your production capacity, operations, and the stress it causes for other staff members.

This might be an opportunity to restructure by promoting another employee into this essential role and hiring for their position at a lower cost instead.

3. Squashing Your Marketing Budget

Slashing your marketing budget when the going gets rough might seem like an easy way to cut costs. However, you might be doing more harm than good. Implement a program to calculate and track ROI on marketing dollars spent before making any hasty decisions.

A recent article from Harvard Business Review [2] found companies that did not cut their marketing spend strongly bounced back from previous recessions - and actually, in many cases, increased it.

You’ll have more of a ‘voice’ than your competition that makes the hasty decision to pull back.

The most important reason though, is that it will take you off course to meet your goals and that could make it much harder to bounce back.

4. Overlooking Vulnerabilities

It's easy to ignore your company's vulnerabilities in an economy full of consumers who are happy and willing to spend, and nothing reveals a business's weaknesses quite like the keen sting of an economic downturn.

Take action now to identify your company's soft spots by evaluating your pricing model and looking at worst-case scenario cash-flow forecasts, in addition to profit and loss statements for your customers, products/services, employees, locations, and more.

5. Failing to Adapt

As the economy changes, your business either needs to make changes in anticipation of or in response to the shifting climate. Failing to diversify revenue channels, adjust growth expectations, and modify your strategy will leave your business exposed to unnecessary risks.

Look for opportunities to sharpen the saw in your business operations, like training, getting feedback from clients and improving, adding to your services where you see needs arising.

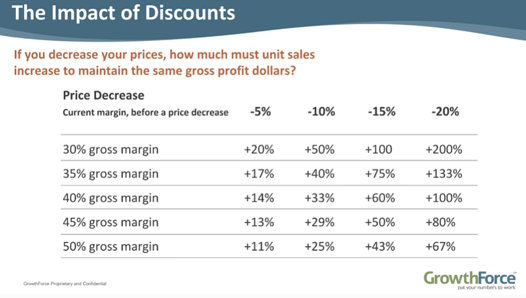

6. Thoughtlessly Discounting Prices

While a recession might necessitate some price adjusting to remain competitive, you should never arbitrarily discount prices to attract customers. Instead, explore new pricing models, packages, and creative contracts to maintain your revenue while continuing to draw in clientele.

For example, if you have a 30% margin, and you give a 10% discount, you have to sell 50% more business to make the same profits.

Discounts do more to destroy your profits than anything else. Giving a discount is not always the answer, and could do more harm to your business than good.

7. Focusing on Low-Profit Revenue Streams

Selling only what you know to be a quick sell isn’t always the answer. You should be focused on the most profitable services/products and those clients that know the value of it.

You may not truly know which of your revenue streams are actually the most profitable without pulling P&Ls on every customer type and job/product type you offer, but if you look at your management reports to dig into this, you will be making better decisions on where to focus.

During a recession, making the most of your resources is more important than ever. Be careful you don't waste resources on high-revenue jobs that generate comparatively low profit.

8. Pursuing All Sales Leads

Additionally, don't waste resources pursuing every lead you encounter. Have a clear process and procedure for qualifying or disqualifying prospects so that you/your sales team only spends time on the right leads that align with your most ideal client profile.

This may also be a good time to re-evaluate your sales approach to improve the process and/or adapt to more meaningful conversations with prospects as they also navigate the crisis.

9. Running Out of Working Capital

As profit margins shrink and expenses grow larger than your revenue, your business stands to run out of working capital. According to a study from U.S. Bank, 82% of businesses fail [3] because of cash flow problems, and during a recession, cash flow shortages will likely occur if you don't make adjustments.

During a crisis, the most difficult decision a business owner has to make is: where do I have to make cuts?

This is not the time to act only on your gut. Emotions are heightened, and businesses that make decisions based on the numbers are better able to keep their doors open during a crisis.

If you are losing money, calculating your break-even point will tell you how much you have to cut.

10. Ignoring or Fostering a Lack-Luster Company Culture

Recessions aren't only hard on businesses; they're also tough on employees (i.e. your people). In the stress of making the right decisions to guide your company through a recession, don't lose sight of the people with whom you couldn't operate without.

Getting bogged down in anxiety, allowing your worries to bleed through your company's hierarchy, and forgetting to show your staff that you appreciate them can quickly destroy the highly productive, positive company morale you've worked so hard to cultivate.

How Businesses grow from a challenging year to a prosperous future...

From a challenging year to a prosperous future- watch how team and technology helped business owners set the tone for a new year.

10 Actions to Take During a Recession

1. Assemble Trusted Advisors

Don't underestimate the value of objective perspectives.

Surround yourself with experienced, intelligent people and communicate freely with them. Reach out to trusted resources or peers that could help by offering advice.

2. Cash-Flow Forecast for Worst-Case Scenarios

The difference between the companies that survive a recession and those that don't? Focusing on cash flow.

Before things get really bad, find out exactly what "really bad" looks like for your business.

Start with your cash flow forecast: your projected sources and uses of cash (we suggest 13 weeks!) Then, revisit and apply cash flow best practices. You'll be able to navigate the road ahead and recover more quickly. Test worst-case scenarios with cash flow forecasting to find out exactly how bad a recession your business is built to weather.

Fortify your finances by making changes now.

3. Make Short-Term Plans

Recessions can be volatile. Plan accordingly by devising short-term strategies for the next three or six months and be ready to modify these as needed.

Re-evaluate written goals and be sure the objectives are in line with what is achievable.

A business leader's attention should shift from focusing primarily on the future to monitoring daily operations. Set several short-term goals, identify the KPIs you can use to track your progress, and stay on top of these numbers every day.

Stay focused on your written goals, those achievable objectives and the needs of your employees so everyone is supported, aligned and focused together.

4. Make Data-Driven Decisions

Get the data you need at your fingertips so you don't make hasty decisions.

The worst thing you can do during a recession is fail to act, but it's easy to experience analytical paralysis amidst the shifting fog of an economic climate in recession. Whatever you do, continue making decisions, but make sure you are making well-informed, data-driven decisions so you’re not just acting on gut.

Identify your highest priorities to make the smartest decisions you can. Don't waste time punishing mistakes when they occur; simply begin moving forward in a better direction as soon as possible.

5. Bolster Leadership + Company Culture

Whether or not you actually feel confident, confidence is exactly what you need to exude during a downturn. Everyone working under you in your business will take their strength, positivity, and motivation from yours.

Lead decisively with your head up and your shoulders back and always remember to outwardly express gratitude for those who are invaluable to your business.

6. Value Pricing

When the emotions kick in, some business owner's natural reaction is to say "Okay, I'll do whatever it takes to get some business in the door."

This is a big no-no.

One of the main causes of cash flow problems is because businesses are not pricing their jobs right to cover profit and overhead. When you start handing out discount, it comes out of your cashflow- the money that would have gone into the bank!

Consider Value Pricing: Your number one priority should be focusing on the value of the product or service, rather than the price. With value pricing, you get paid the exact amount you deserve to be paid, an amount designated for profitability.

7. Refinance Debt

Although harrowing, economic recessions do have their upsides, namely low interest rates.

Take advantage by refinancing your existing debt as soon as they drop. You'll save money on interest immediately and continue saving into the future. Take advantage of help offered (if you need it) from the government or other financial resources.

8. Take Advantage of Inexpensive Acquisitions

Additionally, recessions tend to lower prices. If you have the capital available to reinvest in your business, consider taking advantage of these low prices by acquiring new assets on the cheap. However, be careful not to put your business at financial risk by spending your entire rainy day fund. What looks like a good deal could easily lead to financial over-extension.

9. Communicate with Clients, Vendors, and the Bank.

Communication is key. Call your bank, landlord, suppliers, and clients.

Now is the not the time to go dark. It's time to be honest, transparent, proactive, and pick the phone up to say "Here's where I'm at." Let them know exactly what the situation is so they can plan accordingly.

Communicating honestly is the respectful thing to do as a business owner.

Remember that your clients might be struggling, too. Show you care and ask them how they are doing. Maintain communication with them directly and through marketing to inform them about the changes you're making and how you might be able to work with them.

10. Don't Be Afraid of Change

Remember to adapt. Whether that means adjusting your business model, shifting strategies, or optimizing pricing, be open-minded and assertive in adapting to the ever-changing economy.

Ask your clients how you could improve, what other services they wish you could offer, take this time to do a competitive analysis and see if there is something your competition is doing that maybe you should offer too.

Get Actionable insights into your true bottom line

Recessions foster volatility and financial uncertainty, but you can create financial clarity – even during the murkiest economic times – by keeping a close watch on your business's management reports and key performance indicators.

With access to a plethora of data derived from trailing 12, 6, and 3-month charts, profit and loss statements, and more, you'll always have a firm grasp on your business's past, present, and future finances.

With this vital information, you'll have the ability to make solid, proactive decisions that will guide your business through the next recession to emerge successful on the other side.

[1] https://www.bls.gov/news.release/pdf/empsit.pdf

[3] https://www.businessinsider.com/why-small-businesses-fail-infographic-2017-8

.png?width=563&height=144&name=New%20GF%20Logo%20(37).png)

![5 Steps To Power Through 2021 How Smart Business Owners Get Stronger In A Recession [WEBINAR] Sign Up!](https://no-cache.hubspot.com/cta/default/549461/fcba028d-f3ee-4ae0-ae8a-d3eeb774803c.png)