9 min read

There are quite a few differences between service businesses and product businesses. For example, you can't put a patent on legal services, you buy materials in bulk to drive down your costs, and you can't simply add a markup on the cost of your product to price effectively.

|

Key Takeaways

|

But most importantly, your strategy running a service business vastly differs from those businesses selling products.

Whether you run an engineering firm or own a marketing firm, an IT company, or another type of service business, you need to think about your business strategy a bit differently from the owner of an average brick and mortar shop selling products.

Three Ways to Leverage Strategy in Service Business

1. Know Your True Costs

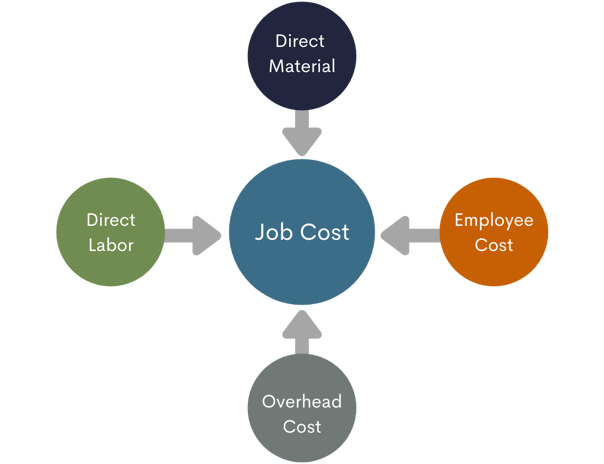

In a service business, you can't simply reference your receipt for your bulk order of widgets to determine your costs. When people and their time working for you are your biggest expense, you must implement a strategy to determine your true costs of doing business, and you can do this with time-driven activity-based costing (job costing).

Job costing considers both the direct and indirect expenses in your company, including labor costs, and uses time tracking to allocate them to certain units of your business's operations. For example, job costing allows you to determine the exact cost of providing a certain service such as putting in a swimming pool. It also enables you to calculate the cost of providing a company with an estimate.

Read More: Why Every Service Business Should Have Job Costing

You can use job costing to get to know your true costs, and this allows you to determine which parts of your business are the most profitable (i.e. have the strongest profit margins), which are the least profitable, and which might actually be costing you money.

To job cost accurately, however, you need to implement a system for highly accurate time tracking to determine how much time each of your employees spends on certain tasks. You also need to track and categorize all of your non-labor costs, too.

Once you know how much time employees spend on tasks, you can divvy up other indirect costs by percentage of time spent on tasks to allocate the right portion of costs to each type of job.

If you do not have accurate means of tracking employee time, then we recommend divvying up indirect costs based on an estimated percentage of time spent on certain tasks or based on a specific task as a portion of all the tasks performed in your company. So, the jobs performed more frequently would receive a higher percentage of jobs that only need to be done every once in a while.

When you know your true costs, you can identify your company's true profit drivers in your various revenue channels and among your people.

2. Optimize Prices

Pricing is another strategy that you can use to increase your profitability. In a service business, there are two models for pricing that work particularly well. These are pricing for profit margins and value pricing.

Pricing for Profit Margins

When you optimize pricing for profit margins, you first set the desired margin and then add a markup to accommodate that margin based on the true costs which would have been derived with job costing, and you do this for every service type, job, or "product" that you offer.

While pricing for profitability is the best way to sustain healthy margins and remain profitable in your business, they can be difficult because they do require you to know your true costs of doing business. This can be tricky if you don't have the correct tools and technology in place to automate expense tracking and categorization and time tracking.

Value Pricing

Value pricing works quite a bit differently than profitability pricing because it looks at the intrinsic value and perceived value of your services compared to your competitors and bases your pricing model on these two factors.

Value pricing aims to charge what you're truly worth, and if you have a good reputation in your industry, set the bar as high as you can to test how much your clients are willing to trade for the value of having you on their team.

Value pricing not only has the potential to allow you to charge more for your services than your competition, but it can also be a boon to your marketing efforts. While no one expects to attract more business by charging more for their products, in service businesses, pricing and perception of quality are completely intertwined. As a result, charging less to beat out your competition could actually result in potential clients perceiving your business's value as less.

This service-based business was able to make pricing decisions that helped them jump from break-even to seven figures of profit in less than a year.

How did they do it? It starts with microscopic insight into their finances. When they renegotiated pricing on their lowest margin clients, the difference went right to their bottom line. 👉 Read More Stories Like This One

“I now have insights into my numbers that helps me maximize my people and increase our profits.”- Peta Hoyes, COO, Tag1.

For example, no one ever brags about hiring the cheapest legal counsel available; they brag about hiring the most expensive lawyer out there because, in service industries, higher costs tend to equal greater value. However, it's important to remember that the most expensive lawyers and other service providers also have good reputations and credentials to back up their prices. While you don't want to ask for more than your worth, you should also never undercut yourself.

Read More: You’re Making A Mistake With Your Pricing If You Don’t Do This...

3. Assign the Right People to the Right Tasks and Automate Low-Value Processes

In service businesses, especially ones where you have highly paid experts on staff, one of the biggest costs is assigning low-value tasks to highly paid employees. Before assigning any tasks, each process should be valued and assigned accordingly to the most appropriate person on staff.

For example, in an engineering firm, your engineers – the highest-paid employees – should be focused on developing relationships with clients, design approvals, and other high-value tasks that actually generate revenue for the company. While lower-paid employees spend their time on lower-value tasks like administrative work, research, and permit filing.

Read More: 3 Strategies to Scale Beyond Your 7-Figure Consulting Business

Additionally, you should actively look for tasks in your daily operations that can be automated and invest in the tools and technology that will allow you to do so. This not only saves you money on labor costs and increases the ROI on labor costs but also improves each of your employee's experience on the job.

4. Increase ROI on Labor Costs

In service, your product is your people.

So, labor costs tend to be the highest expense and usually make up the highest portion of your cost of goods sold.

At first glance, it might appear like there is not much you can do to control labor costs, increase your ROI on labor costs, and increase the productivity of your people. After all, there are only so many hours in the workday and only so much each person can do.

However, you can take control of these profit drivers and increase the profitability of your people by marrying your human capital strategy and your financial strategy. Yes, you can increase the ROI on labor costs by getting your human resources department and finance department to work together.

Read More: The Most Profitable Service Businesses Do This Really Well

These two departments should not be at odds with each other – one appearing to spend money while the other one makes it. They should be working together to determine the human capital management strategies that empower your people to do more by working more efficiently and more spiritedly.

To start, you should think about beginning to really invest in your people and your workplace culture with team building activities (choose activities that your people will actually enjoy – you know them best), recognition of achievements, and rewards for achievements.

5. Implement an Operating Framework

To align – not just your finance department and human resources department – but every department, person, and daily task in your business around a common vision and common goal for the company, you need an operating framework.

An operating framework is all about setting SMART goals for the long-term and short-term benchmarks in your business that are designed to motivate, organize, unify, and rally your entire company around your common vision.

An operating framework outlines what you want to accomplish, how you want to accomplish it, who should be doing what to accomplish it, how you'll measure the accomplishment, and how soon you plan to accomplish your goals. It defines exactly how you will communicate the goal with meetings and assignments and how you will reach your goal by setting short-term benchmarks for every department and every person in every department.

Any task that doesn't service the operating framework or that works against it, should be eliminated and replaced with something that's aligned with your company's greater purpose.

An operating framework gets everyone in your company pushing the business forward in the same direction. It establishes a clear pathway to measurable success so you can let your numbers guide you.

An operating framework also gives every person personal ownership of the company's accomplishments and, as a result, more fulfillment in the completion of their day-to-day tasks. You might even find that, working within an operating framework, employees are even more motivated to go above and beyond their normal roles and responsibilities.

Support Your Strategy With a Strong Back Office

In a service business, each of these strategies will help you cut costs, increase productivity, improve your ROI on labor costs, and strengthen your profit margins. Leveraging these strategies, however, requires you to know your numbers and this means having a robust back office that can generate timely and accurate financial data – without being a drain on your resources.

In a service business, where you already have high labor costs, there's no reason to hire more in-house employees to operate your back-office processes. Instead, a final strategy that service businesses can leverage to improve their profit margins is to outsource non-central business functions to experts outside of the company, including bookkeeping and accounting.

This saves you on overall labor costs while getting you access to experts in their fields. Partnered with an expert outsourced accounting firm, you'll have the financial data you need to set and track your progress toward goals, make good decisions for your business, and improve profit margins to generate the free cash flow you need to grow and expand.

.png?width=563&height=144&name=New%20GF%20Logo%20(37).png)