9 min read

.jpeg?width=878&height=585&name=AdobeStock_206023833%20(1).jpeg)

Some small engineering firms can get by with just the back-office essentials: a sound, secure, and efficient bookkeeping and accounting system that maintains compliance while supporting the nuts-and-bolts operations of the business.

|

Key Takeaways

|

If your engineering firm is growing, however, or you have plans for growth or other changes, then your firm is likely in need of the knowledge, expertise, and assistance of a chief financial officer (CFO).

What Is the Role of a CFO?

The overarching responsibility of a CFO is to manage the big-picture, strategic aspects of a business's finances.

The CFO should take charge of the management aspect of accounting by helping with tasks like financial planning, risk assessment, cash flow improvement, financial forecasting, budgeting, fundraising, and communicating financial information with stakeholders inside and outside of the company. Additionally, CFOs should have extensive industry experience and a vast network that they can leverage on behalf of the business.

8 Signs Your Engineering Firm Needs CFO Services

If your engineering firm is experiencing any of the following situations, then it most likely stands to benefit greatly from a CFO's expertise.

1. Experiencing Rapid Growth

Rapid growth can create confusion as old processes can no longer handle the increased workload and cash inflows and outflows become increasingly complex. During a rapid growth phase, your engineering firm will also need to change rapidly to keep up with the increased costs associated with growth, the increased need for capital, and the necessity of keeping profit margins strong throughout. The challenges stirred up during growth phases can be greatly alleviated with the knowledge, experience, and network of investors that a CFO brings to the table.

Read More: How to Scale Your Engineering Firm in 2023

2. You Want to Grow

Additionally, if you want to grow your small engineering firm, a CFO can help you better delegate tasks throughout the company so that you have time to focus on the strategy of expansion. Additionally, a CFO can help you identify which areas of your business are the most profitable, and thus, also the most advantageous growth centers. Once you have a strategy for what you want to grow, your CFO can establish a financial strategy to ensure the growth strategy is properly and sustainably funded.

3. You're Planning to Reinvest in the Firm

If you're planning to reinvest in your engineering firm, this means you're also planning to take on a new expense. If these investments are substantial enough that you stand to shrink profits, then your business could benefit from the experience of a CFO who can help guide you through this process and ensure the business's finances are strong enough to withstand the cost of new endeavors, equipment purchases, or hires.

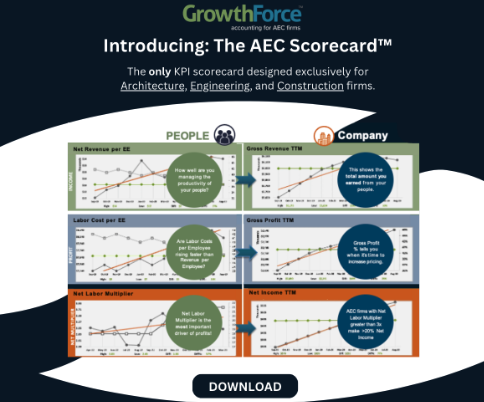

The AEC Scorecard™: The 6 KPI Charts That Every AEC Firm Should Be Tracking

4. You Need to Cut Costs

A CFO's strategic financial management knowledge can help you trim the fat in the most efficient and effective ways possible. Keeping costs low is important for the health of your bottom line, but you don't want to cut expenses that generate a strong ROI. Your CFO can help you interpret your company's financial data in a way that sheds light on the most expensive expenses, in terms of their individual profit margins and ROI. As a result, you can cut costs that cost you money and keep the costs that make you money.

5. You Need to Raise Money

If you're looking to generate capital from investors, then you'll want the assistance of a CFO. A CFO can ensure your business is properly valued and that these investment deals are structured in ways that benefit the business, in addition to using their extensive financial networks to help you team up with smart investors, rather than any investor. It's always better to partner with someone who understands your industry or who can bring something additional to the table to help ensure their investment and your business are successful.

6. You're Interested in Mergers and Acquisitions

M&A processes are complex and subject to a whole host of regulations, not to mention the internal shuffling of employees, resources, expenses, cultures, policies, processes, and budgets that are also necessary as a result of this kind of growth. If your engineering firm is looking to acquire or merge with another firm or business, then you'll want to be sure you have a CFO on board who can handle the M&A preparation phase, the process of merging or acquiring, and the complicated transition that must occur after the merger or acquisition is complete.

7. Your Firm Is Going Public

The process of going public is complex, and just like with M&As, it's also rife with regulations with which you'll need to be compliant. If you're preparing to go public with an initial public offering, you'll need a CFO to handle this complicated process and ensure your company launches into this new arena smoothly and successfully.

8. You Need Expert Guidance

CFOs are experts themselves, but they can also offer the value of their own networks to the businesses they work for. So, a CFO can put you in touch with a wide array of experts and successful individuals in your industry or in adjacent sectors that could benefit your firm. As a result, you'll be able to learn and benefit from these connections and the experiences of others.

How Outsourced CFO Services Can Help

Bringing in a full-time CFO is an expensive proposition, and the standard CFO salary is a little too rich for most SMBs. Plus, most SMBs do not require the services of a CFO all of the time. So, hiring an in-house CFO results in you paying a full-time price for an employee that you only require part of the time.

Engineering firms, however, can still tap into the knowledge, expertise, and services of a CFO by outsourcing a fractional CFO. Outsourced or fractional CFO services are those provided by a third-party provider, rather than an in-house employee. With outsourced services, you can access a CFO at a fraction of the cost and have them work for your company, as needed. As a result, you pay for and receive the CFO your small business can afford and that it actually needs.

Choosing Fractional CFO Services for Engineering Firms (CFO Services Best Practices)

When selecting an outsourced CFO for your business, it's important to choose a reputable provider who has direct experience working in your industry or with your type of business. This is an important role that you'll be filling, and your outsourced provider is going to provide you with essential strategic advice that can help take your business to the next level, if (and it's a big IF) you choose a good outsourced CFO. So, what should you be looking for when shopping for a fractional CFO?

Read More: How Much Do Outsourced CFO Services Cost?

The following are some of the most important factors to consider when choosing an outsourced CFO services provider:

- Your Needs - Before you begin shopping around, consider what your company's needs actually are. How do you want to benefit from a fractional CFO? How much communication do you want to have? How much dedication do you need? What are your company's financial goals and how do you want your outsourced CFO to assist with those goals? Defining what your business actually needs from a CFO can help you create a list of services that you want your CFO to provide. This will help you choose the right CFO services during the selection process.

- Credentials, Track Record, and Industry Experience - Be sure to look into your outsourced provider's history. What are their credentials? Do they have the necessary education and certifications? What financial management experience do they have? How many other engineering firms have they helped? What is their experience in the sector and industry? How have their clients' businesses improved as a result of their services?

- Company Reputation - Is the outsourced provider working for an outsourced accounting services company? What is the company's reputation?

- Coverage - Will you have a team dedicated to your business's back office and financial management or will you be working with one individual? What happens if that person gets sick or goes on vacation? Is there coverage for your account?

- Your Budget and the Cost - While your business stands to improve its financial position as a result of hiring an outsourced CFO, you must still consider how much you can afford to pay and how much you are willing to pay for these services.

- What You Get - Be sure you are clear about the terms of your contract before signing up for outsourced services. Make sure you understand the full range of services that are available to you and what is included with the level of services you are signing up for. Then be sure to fully utilize all of the services you choose to pay for.

- Communication - Choose a provider who communicates clearly and readily, and be sure you understand how much communication and availability come with your service package. For example, do you want a CFO who attends strategic meetings and is always available for phone calls, someone you can email weekly, or someone who offers monthly check-ins?

If your engineering firm is entering a growth phase, looking for new ways to expand, considering any other significant financial changes, or simply in need of more insightful financial management and more profitable business management, then your business will benefit from the experience of an outsourced CFO.

.png?width=563&height=144&name=New%20GF%20Logo%20(37).png)