1. If you're Spending more time as CBO (Chief Bookkeeping Officer) than CEO

Did you know that multitasking may be costing your business productivity? According to a study cited by the American Psychological Association, the mental blocks that result from repeatedly shifting between tasks can cost upwards of 40% of a person’s productive time. If you spend as much—or more—time handling your financial records, payroll, and other related accounting services as you do working with clients, it may be time to look into outsourcing your accounting services.

When it comes to building and maintaining a well-managed bookkeeping department and developing best practices for financial system design and integration, a growing small business that attempts to ‘do it all’ may find more pain than gain. Whether it’s under-trained or over-worked staff, or incorrect or inefficient bookkeeping procedures, both pains lead to similar results – inaccurate financial data, delayed financial reporting, and fiscal uncertainty.

If your business is heavily reliant on a few key employees to fulfill numerous roles and tasks for the company, then outsourcing your bookkeeping functions may be a viable alternative to building the needed internal capability from the ground up.

Even if things are rated as “good enough,” you’re likely missing out on a valuable opportunity to take a status quo task and turn it into a goldmine of strategic opportunity.

2. You haven't implemented separation of duties

If the person writing your checks is also the person reconciling the bank statements, your business may be lacking internal controls and separation of duties, a serious risk for small business fraud.

Small Business Fraud Costs More Than You Think!

From billing and payroll fraud to check tampering and skimming, there are a plethora of occupational fraud methods employed by thieving employees to unburden you of your profits. While many small or growth-oriented businesses overlook the importance of implementing systems and strategies designed to reduce their risk, it’s certainly a valuable investment, considering the impact of occupational fraud – the typical surveyed organization had a median loss of $150,000 per case.

The overall goal of internal controls is to make it harder to steal and easier to uncover. In addition to mitigating fraud risks, proper internal controls ensure that the flow of information into your financial system is valid, timely and classified in the right period.

Instilling high standards now will net the high quality information your business needs to make informed decisions and take strategic opportunities in the future.Regardless of your company’s size or number of employees, by outsourcing your accounting and controller duties, your business will benefit from effective separation of duties by inserting an additional level of review.

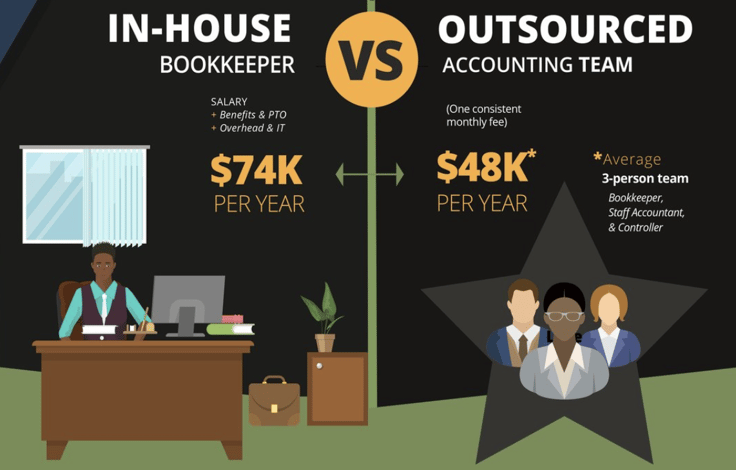

How do your costs stack up? 👇 Speak to a Business Performance specialist to learn more about an outsourced solutikon.

3. If you don't have a plan for when your Bookkeeper quits

What happens when your bookkeeper is sick, takes a vacation, or even worse, quits? Who will complete their work when they are gone? If they were to quit, is there a system in place for someone to pick up where they left off?

At GrowthForce, many of our clients who sought us out saying, “Sign me up!” were initially motivated by either the presence of pain: “My bookkeeper quit” or the search for enlightenment: “I want peace of mind that my books are accurate and on time, so I can focus on scaling my business.” In the first scenario, it’s painfully evident what can happen to a small business without a reliable and trustworthy bookkeeper to oversee the company’s financial health. In the search for enlightenment, the driving force behind the decision to outsource bookkeeping is the ability to focus on core competencies for the overall benefit of the business.

Besides the frustration of having to deal with overdue data entry, and less-than-useful reports as a result of inaccuracies, outdated financial processes can actually cost your business significant money.

4. If you make Business decisions without timely, accurate, and actionable financial intelligence

When you employ a knowledgeable accounting professional to follow disciplined record keeping and KPI reporting, you can count on your numbers and keep your finger on the financial pulse of your business.

Accurate, timely and actionable financial information will enable you to make data driven decisions and you can avoid making serious mistakes.

A study of successful businesses conducted by the Geneva Business Bank found that businesses planning out their cash flow on an annual basis only have a 36% survival rate over five years, but those doing it monthly have an 80% survival rate. Cash is the lifeblood of any business, and you need to know exactly how much money is coming into and going out of your business in order to correctly guide the decisions you make. Cash flow forecasting is just one example of management accounting that will help your business thrive.

One of the top drivers behind a business’s decision to outsource is access to the expertise, specialization and world-class capabilities delivered by service providers. By tapping into their extensive investments into technology, methodologies, and people, your business gains a competitive advantage while avoiding costs associated with chasing new technology and training. For instance, part of GrowthForce’s initial setup includes an examination of your internal processes. This often leads to breakthrough improvements in efficiencies and performance measures.

Just imagine the power and competitive edge that comes from making strategic decisions based on timely financial data and critical reports, such as your Key Performance Indicators (KPIs)!

By outsourcing your bookkeeping and accounting, your business is better positioned to scale instead of building an accounting department. As a result, your head can stay in the game instead of in the books. This also means your most valuable resources, your employees, are able to focus on core activities that benefit your clients and add greater value to your overall business. Thus, when you leave it to the management accounting and QuickBooks system experts, you can focus on meeting the needs of your core business – your clients - which is what keeps you in business in the first place.

Top Reasons Companies Outsource Their Bookkeeping:

- Cost-Effective

- Expertise

- Accuracy

- Consistent Reconciliation

- Backup

- Focus on core business

- Fraud Prevention

Why Outsource Your Bookkeeping? It’s Cost Effective!

- Reduction in employer payroll taxes.

- No worker’s compensation insurance.

- No medical insurance or other benefits to pay.

- No retirement plans.

- No vacation or sick days to consider.

- No placing classified ads, screening interviews, testing and training.

(Source: Outsourcing Institute)

.png?width=563&height=144&name=New%20GF%20Logo%20(37).png)