6 min read

.jpeg?width=768&height=475&name=AdobeStock_309510089%20(1).jpeg)

You exit your nonprofit's latest board meeting, having just been elected or appointed treasurer – now what?

|

Key Takeaways

|

If you feel overwhelmed wondering what your role and responsibilities will be and how you will be able to accomplish the task while helping your organization achieve success, you are not alone. Fulfilling the duties of a treasurer for a nonprofit organization is a big job, and doing it well is a considerable challenge.

With the right strategy, skills, and accounting know-how, however, you can be successful in your new role and boost your non-profit organization into a brighter financial future.

Are You Well Suited for the Job? 7 Qualities Possessed by All Great Nonprofit Treasurers:

- Critical Thinking - You should have the ability to appraise your organization's financial standing, policies, and procedures in order to make recommendations regarding the financial decisions that will be made.

- Aptitude for Organization - All good treasurers possess excellent organizational abilities. They work with accuracy and keep impeccable records.

- Strategic Planning - The ability to synthesize cause and effect scenarios (with regard to potential financial decisions the organization will make) is necessary for a treasurer to accelerate their organization's growth and future success.

- Creativity - When it comes to generating funds and cutting expenses, new ideas and creativity are key in an ever-changing and developing organization.

- Clear Communication - In one sense of the position, treasurers act as financial ambassadors on behalf of the rest of the board. It is essential that an organization's treasurer be able to communicate complex financial concepts in easy-to-understand, jargon-free, layman's terms.

- Basic Accounting Skills - If fortunate enough to do so, non-profit organizations would only select individuals with accounting skills on the level of a CFO or controller. Most often, however, nonprofit boards only expect their treasurers to have basic accounting skills and an aptitude to learn more.

- Knowledge of Your Nonprofit Organization's Bylaws - A firm understanding of the organization's bylaws will ensure you maintain the finances to the standard of the organization's rules and those of your local, state and federal government.

Read More: Reporting Rules For Nonprofit- State By State

Checklist: Transitioning into Your New Role

Once you have been elected or appointed treasurer, there are a few housekeeping duties you should take care of straight away.

✔️ Set up a meeting with the outgoing treasurer to transfer files, ask questions and learn what your new duties and responsibilities entail.✔️Ask for all previous budget information and existing financial documentation regarding purchases and events.

✔️ Create a timeline or electronic calendar documenting due dates for bills and other upcoming payments to ensure a smooth transition.

✔️ Prepare an initial budget early on and ask the former treasurer to double check your work

✔️ You should also ask the former treasurer whether the organization has any undocumented outstanding payments or income of which you should be aware.

✔️ Obtain all bank account records and details. Get the bank forms required to update signature cards and online account access as soon as possible.

✔️ You also need to transfer credit card authorizations.

✔️ Have all checkbooks and credit cards turned over to you that were in the possession of the former treasurer.

As Treasurer, Don't Make These Mistakes!

To ensure success as treasurer, you should never:

- Neglect Separation of Duties and Access Control - Every organization needs policies and procedures in place to protect treasurers just as much as the organizations they serve. Follow the procedures put in place and make changes if you notice lax policies. Do not be afraid to enforce protocol – even if your predecessor neglected this responsibility.

- Shirk Your Financial Reporting Duties - The ability of your organization's board of directors to make sound decisions regarding strategic planning, expenses, staffing and finances directly depends on the timeliness of the financial information at hand. If you neglect your financial reports and records, the board will not have sound data on which to base their decisions.

- Give Tax or Legal Advice - The deductibility of contributions from donors depends on how each donor's unique financial situation fits into their local tax laws. Instead, you should advise donors to speak with their CPAs or tax attorney regarding whether or not they will be able to deduct donations and contributions.

- Make Undocumented, Unapproved Decisions - Some might say that treasurers hold the keys to the kingdom. Never abuse the power by overstepping the decisions of the board of directors and/or executive directors.

Read more: 7 Financial Reports Every Nonprofit Should Monitor

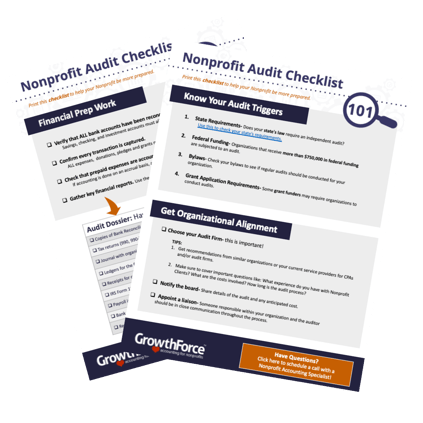

Is Your Nonprofit Prepared For Your Next Financial Audit?

The Complete Checklist To Make Sure Your Organization Is Meeting All Audit Requirements.

The Ongoing Duties and Responsibilities of a Nonprofit Organization's Treasurer

1. Oversee the Organization's Financial Administration

Depending on the skills of the staff, the treasurer may be responsible for managing the everyday activities of an organization's finances. This includes managing cash flow, paying and recording bills, maintaining a record of debt, selecting a bank and reconciling statements. The treasurer should also have a firm understanding of the organization's bylaws and laws that apply to the organization.

2. Review and Enforce Financial Policies and Procedures

As treasurer, you are responsible for safeguarding your organization's finances. A large portion of this protection should already be built into the organization's bylaws.

If your nonprofit is fairly new, however, you might need to carefully consider these bylaws and potentially institute additional policies and procedures when it comes to handling the organization's finances. Be sure you are working with separation of duties, if possible, a paper trail and dual signatories on checks. We suggest you implement bill.com so you set up rules and workflows so, for example, checks over $5,000 require two (digital) signatures.

3. Generate Financial Reports

As treasurer, it is your responsibility to generate accurate financial reports at period ends and deliver these to the appropriate individuals (usually, executive-level employees and board members).

You will use data from your company's chart of accounts to generate these vital reports; keeping accurate bookkeeping records is essential to generating accurate reports.

Financial reports usually include budgets, the profit and loss statement, balance sheets and a cash flow statement (and/or cash flow projection).

4. Create a Budget

You will likely need to work with board members, the executive director and program directors to create an overall budget (financial projection model) and specific budgets for individual programs. When creating a budget, remember that, as treasurer, you have the best understanding of the types of expenses the organization can afford.

5. Advise the Board on Financial Strategy and Fundraising

In addition to budgeting, treasurers work with the board of directors to provide advice regarding potential opportunities, risks and tax implications of future financial plans. They might also be consulted regarding grants, proposals, investments and plans regarding unexpected funds and/or cash flow shortages.

Using the principles of GrowthForce's smart back office and system methodology, you can optimize your nonprofit's financial operations, reduce needless expenses and make the most of your fundraising efforts with real-time, actionable financial data. Management accounting allows you to take your role and your non-profit to the next level with management reporting, specifically designed to help directors of non-profit organizations make data-driven decisions to increase funding, encourage growth, broaden the footprint of their outreach, expand their missions and ultimately achieve success.

Maximize your Impact As A Nonprofit Treasurer With Comprehensive Financial Reports

As an ambassador of the board, it is important that a nonprofit treasurer is able to communicate complex financial concepts by sharing timely and accurate information, such as the statement of financial position, statement of cash flow, budget vs. actual (both overall and by program), profit and loss statements (both overall and by program), and restricted funds budgets vs. actuals.

.png?width=563&height=144&name=New%20GF%20Logo%20(37).png)