.jpeg?width=703&height=456&name=AdobeStock_56034775%20(1).jpeg)

There are three reasons why businesses fail. #1 Cash flow, #2 Cash flow, #3 Cash flow.

You’ve likely heard me say this before, but I say it once again because this is especially true for rapidly growing businesses.

When your business is growing fast, the most valuable thing you have as a CEO is your time. You need to be in control of the rudders on the ship and you really don't want to be worried about chasing cash.

Your business may be growing and you may be making money, but as the business grows, so do expenses and if you are short on cash, that is the first sign that your business cash flow may quickly spiral downward. Companies that are growing fast have cash flow problems more frequently, and with more severe potential consequences than slower-growing companies. So good strategic decision making becomes more critical as you grow.

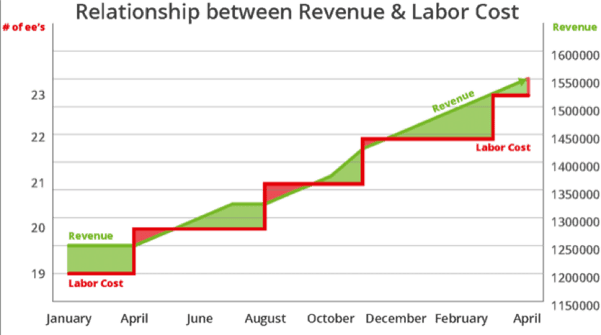

One continually difficult decision involves the relationship between revenue and labor costs – when do you hire based upon anticipated growth – because you typically have to pay people before your business gets paid for their work. The more people you have to hire because you are growing the more complicated it gets.

Salaries are a step up in costs – Every time you hire it creates a step up in expenses – Whereas revenue is a slope function. If your revenue doesn’t match the timing of your step up, you get into the red. This is the single biggest challenge in a service business.

Big Opportunity + Big Growth = Bigger Decisions

When you have big opportunity, you have big growth which means you are making more impactful decisions. So, if you have to spend your time on cash flow issues, it's taking you away from maximizing these big opportunities.

When you’re short on cash, you start making hasty decisions. In some cases, you may make business decisions that lead to cash flow issues. Once you are in a cash flow crunch, your decision making ability is further impacted by lack of resources and fear, like making hasty decisions on pricing. For example, offering just a 10% discount means you need 33% more sales to compensate which could cause future cash flow issues.

How Cash Flow Problems Force Business Owners into Bad Decisions

So what can you do to confidently manage cash flow during rapid growth in your business?

Here are 3 areas to fine-tune for the management of your cash flow to be sustainable throughout your business’s rapid growth:

Optimize Your Pricing

Optimizing your pricing model will have the biggest impact on cash flow.

Cash Flow problems cause you to not re-examine your pricing model or experiment with value pricing because you are too scared to lose business. CEOs sometimes tend to make the mistake of offering discounts to generate cash when cash flow is fluctuating as a quick fix. It may feel like the right decision because you feel the urgency, but the long term effect is not sustainable. If you have a solid pricing model and a plan to experiment with value pricing, you won’t get backed into making ad-hoc pricing mistakes that will end up having long-term effects. How well you price your products/services and the margin it produces is the key to maximizing cash flow.

4 Guaranteed Ways to Improve Cash Flow and Optimize Pricing

Streamline Your Billing and Collections

One of the most critical things you need to do is to review your billing and collections process – Sharpen the saw.

The key is streamlining processes to get both staff and clients in alignment. You will solve a lot of cash flow problems if your clients understand when and how you need to get paid for the work that you do. If you leave that unsaid, you’re leaving it to the client’s assumptions which will likely cost you time & money. Include payment terms in your contract and make sure you understand how and when you’re client pays their bills before you start any more work.

Implement collections strategies and adopt collections best practices for your business, to improve the likelihood that you will get paid on time or even in advance.

5 Collections Strategies to Improve Cash Flow

Review and Adjust Your Spending

When your business is in the midst of rapid growth, you’re often faced with big spending decisions to advance your business’s infrastructure – location, hiring, inventory, equipment, technology.

If you're having cash flow problems, it will be challenging to make necessary investments to accommodate the growth or take advantage of opportunities that come your way. Think for example if you’re a supplier and your biggest vendor reaches out to you with new deal they are offering for a limited time. They offer to give you a discount of 25% off if you buy all at once. That’s huge for you! It’s an instant competitive pricing advantage because you have lower costs. But you won’t be able to take advantage of the opportunity if you don’t have the cash to do the deal.

Also, in terms of spending, you want to take educated risks – By tracking valuable KPIs over the year, you can gather actionable financial intelligence that will help you quantify ROI and make good long-term decisions on spending.

Fine-tuning these three areas of cash flow management enables your business to be scalable. Scalability will help you successfully grow and adapt to increased volume without compromising on quality, performance, service, or any element that’s key to your business.

Unfortunately, it’s not unusual for business owners to put the cart before the horse, so to speak. When growth is put ahead of building a scalable infrastructure, leaders are likely setting themselves up for major obstacles when their business starts expanding, including creating critical cash flow issues.

.png?width=563&height=144&name=New%20GF%20Logo%20(37).png)