6 min read

.jpeg?width=600&height=400&name=AdobeStock_613355555%20(1).jpeg)

A business's back office has many moving parts, and each piece must operate within a sound framework to function properly.

|

Key Takeaways

|

Without an experienced and knowledgeable individual keeping the back office standing up straight, it would collapse like an improperly designed tower. So, who is this powerful person responsible for holding your back office together? It's a controller.

What Are Controller Services?

A controller is an accountant with a degree and usually at least ten years of experience who manages the bookkeeping and accounting team while overseeing the operation of the department.

At times, the line between a controller and a chief financial officer (CFO) can become somewhat blurred because they are both managerial positions. Typically, however, a CFO's role is grounded in the business's finances but more strategic and visionary (like a CEO). A controller's role, on the other hand, is more backward-looking, focused on maintaining systems, records, and compliance.

What Is Included in Controller Services?

At the head of the bookkeeping and accounting department, controllers have a great degree of responsibility. Their duties encompass a wide range of tasks and responsibilities, including the following:

- Development, implementation, and oversight of the bookkeeping and accounting systems, processes, policies, and procedures

- Oversight of daily processes, record keeping, and transactions

- Financial reporting

- Ensure compliance

- Monitoring internal controls

- Mitigating fraud risks

- Accounting software implementation, training, and integration

- Audit management

The Cost of Controller Services for Businesses

The cost of controller services for businesses can vary greatly, depending on whether you hire a full-time controller, bring in a part-time contractor, or outsource to a third-party bookkeeping and accounting services provider.

Read More: Biggest Accounting Challenges (And Solutions) For Architecture Firms

According to Salary.com, the average annual salary of a controller working in the United States is $105,000 [1]. Plus, as every business owner knows, in-house employees cost a lot more than their salaries. When you add in benefits and additional costs such as payroll tax, health insurance, worker's compensation insurance, paid time off, retirement plans, office space, and additional IT expenses, the cost of hiring in-house begins to snowball. According to the U.S. Bureau of Labor Statistics, the average additional cost of an in-house employee is $13,000 [2].

This means, on average, hiring an in-house controller could cost your business about $120,000 annually - and that's just for your controller. If you're planning to create an in-house team, you'll also need to factor in the price of one or two bookkeepers (to ensure you have a three-person back-office team for the purpose of adequately separating duties) and possibly a CFO.

How Much Are Outsourced Controller Services?

The price of outsourced controller services can vary, depending on the level of controller services your business requires and the volume of transactions passing through your back office each month.

Outsourced services are typically available with a monthly or annual subscription that can be easily adjusted as your business grows and changes. Fees for an outsourced controller usually start out with a range of $2,500 to $4,000 per month. High-quality, outsourced controller services are always less expensive than hiring in-house, and outsourced services deliver much more than a part-time contractor.

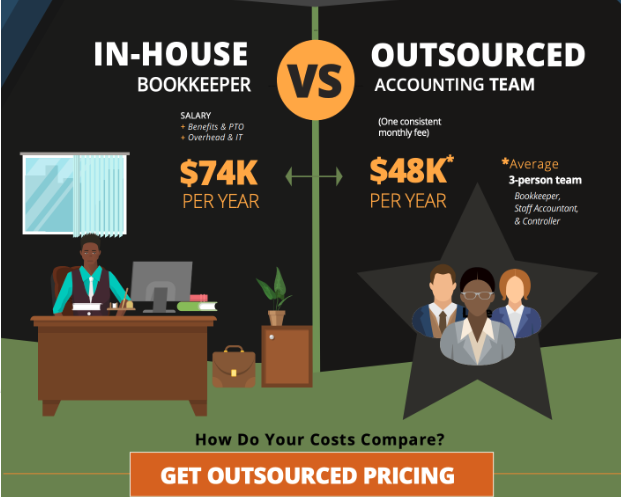

Outsourcing Costs Vs. In House Cost: Analysis

What's the cost comparison in 2023 between an in-house vs. outsourced accounting team?

Get a custom quote (plus download the full infographic)

Why Outsource Controller Services? Additional Benefits of Outsourced Controller Services

In addition to spending less, outsourced controller services along with outsourced bookkeeping and accounting can benefit your architecture firm in several ways.

More for Your Money

When you outsource your back office, you can access a three-person team for the price of one. This delivers the team, tools, and technology your business needs to thrive at a fraction of the cost (and stress) of hiring and managing an in-house team.

More Efficient and Effective Bookkeeping and Accounting Systems

One of the primary functions of a controller is to design a bookkeeping and accounting system that maximizes efficiency and improves operations. By outsourcing your back office to an experienced controller, your business will benefit from automating manual processes with fully integrated accounting technology to create a high-functioning system of bookkeeping and accounting policies and procedures.

Back-Office Oversight

A controller is also responsible for overseeing the proper function of your business's back office. So, you can rest easy knowing that the proper records are being kept securely and that they are well-organized for future access.

Reliable Financial Reporting

With a high-functioning back office, you'll have easy access to timely and accurate financial reports. Available with the click of a button, you can check in on your firm's financial health at any time.

Read More: Financial vs. Management Reports: What AEC Firms Need to Know

Mitigated Risk and Fraud Prevention

Controllers are responsible for developing and upholding bookkeeping and accounting processes, policies, and procedures that are designed to help reduce the risk of internal fraud. This will keep your business's assets secure while also safeguarding your firm from the risk of reputational damage.

Exceptional Compliance

Businesses operating in the AEC industry have their own unique set of accounting standards to uphold and reporting requirements to meet. Choosing to outsource controller services means you'll have access to a large pool of controllers with diverse backgrounds and experience. Select a controller with direct experience working in the AEC industry to ensure you never need to worry about whether you're keeping up with compliance and regulations inevitably continue changing in the future.

Access to the Best Controllers

Outsourcing not only gains you access to controllers with the industry experience your business needs, but it also helps you access and afford some of the most talented controllers in the bookkeeping and accounting industry. Since accounting firms can offer these professionals the best opportunities in terms of upward mobility in their own industry, accounting firms typically attract the top talent working in the field.

No Employee Coverage Worries

With outsourced controller services, you do not have to worry about your controller falling ill, going on vacation, or quitting their job because you will always have a highly skilled controller to take their place if they are away - and this is definitely not the case with in-house hiring which can be quite complicated as a result of turnover or time off.

Flexible and Scalable

Hiring in-house to grow a back-office department takes time, planning, and resources. Plus, when hiring in-house, you'll need to make a lot of room in your budget to expand your back-office department as your business grows. Outsourcing, however, allows you to easily scale and adjust the services you receive, as your business needs grow and change - at a fraction of the cost of hiring additional in-house employees.

Outsourcing: The Path to Your Business's Bookkeeping, Accounting, and Controller Best Practices

With outsourcing, your business can tap into highly talented controllers in addition to bookkeepers, accountants, and even CFOs. With outsourcing, you can build an entire back office department without having to bear the burden of the cost of so many highly educated in-house employees. By allocating your back office's financial resources so smartly, you'll maximize your ROI on your back-office spending while leveraging your financial data to improve operations overall.

[1] https://www.glassdoor.com/Salaries/controller-salary-SRCH_KO0,10.htm

.png?width=563&height=144&name=New%20GF%20Logo%20(37).png)