Gross profit is one of the most often overlooked and underused areas of the income statement. Yet, gross profit and its partner gross profit margin are essential components of the most important decision that a small business owner will ever make: how to price a job.

Gross profit is one of the most often overlooked and underused areas of the income statement. Yet, gross profit and its partner gross profit margin are essential components of the most important decision that a small business owner will ever make: how to price a job.

It sounds like a clear-cut exercise. To set a price on a job, you calculate the costs to deliver a service or provide a product. Once the costs are forecasted, you then build in a profit to determine a price to your customer. However, when job costing, many business owners don’t price strategically, keeping a gross profit margin target in mind.

You’ll see that’s the secret to profitability: setting and using a gross profit target to be able to cover all of your business’s expenses.

Know the Difference: Gross Profit vs. Net Profit

The first step towards understanding and improving profitability is to know the difference between gross profit and net profit.

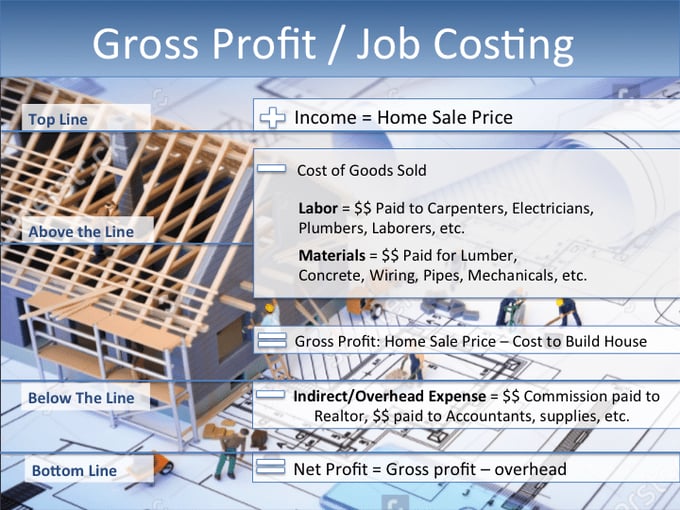

Gross profit is the profit after cost of goods sold is subtracted from net income (often called sales revenue). In other words, your sales on a specific job minus your direct expenses associated with that job will be your gross profit on that job. Direct expenses include direct labor and direct materials.

Whereas, net profit is the profit after indirect expenses are subtracted from the company’s total gross profit across all its jobs. Indirect expenses are those fixed overhead costs of doing business such as rent, supplies and back office employee salaries not directly related to a job or a customer.

The clearest way to explain the difference between the two types of profits is to show an example of a job such as building a home.

What is Gross Profit Margin?

A business owner cannot simply measure the amount of gross profit on jobs to gauge which jobs are the most profitable. The best way to look at your profitability is to track gross profit margin, which is gross profits as a percent of revenue. Gross margin percent (typically not found on an income statement) is calculated as follows.

(Gross Profit divided by Revenue) X 100 = Gross Profit Margin %

EXAMPLE: ($1,500,000 / $4 million) x 100 = 37.5%

Looking at gross margin percentage is the best way to track profitability of a job. That’s because while your income may be growing, your gross profit could be shrinking. You won’t recognize that fact unless you see the relationship between the two as a percentage.

Gross profit tells a story

Both gross profit and gross margin measure how well a business is using its resources to produce a product or a service – typically, the higher the gross margin percentage, the healthier the business.

However, a company’s industry and its product also factor into gross margin percentages. For example, a service business, where employees’ time is the product, would have a higher gross margin on average than other industries. This is because it doesn’t have direct material costs that must be deducted from sales.

When evaluating gross margin, business owners should also compare their metrics with the industry average to determine how the company stands versus its competitors. If your gross margin is too high versus the industry, you can do a little detective work to find out why. It will be worth the time and the trouble.

In the example above, presume the business had been able to reduce its cost of goods sold expense and had made a 35.6 percent gross margin. That one additional percentage point would have increased gross margin profits to $4.4 million (1 percent × $4 million sales revenue).

By tracking gross margin on a monthly basis and comparing it to the targeted gross margin, a business owner can red flag problems and notice trends. A change in gross margins can provide a manager insight into issues with a job, a client or the company.

Gross margin provides insight into:

- Cost overruns

- Poor pricing decisions

- Profitability trends

- Profitability versus overall company and industry

Improve Your Business's Profitability

Making a profit on the bottom line starts with pricing jobs right to make enough money to cover not only the cost of goods sold, but also the company’s fixed overhead costs. The gross profit margin target must be set at a ratio which allows for an adequate amount of revenue to filter down to net profits and the owner’s pocket book.

By monitoring gross profit, you have a better vision into the company and can see where it is making money (and where it is not). With that information, a business owner can make better decisions which directly affect company profitability.

.png?width=563&height=144&name=New%20GF%20Logo%20(37).png)