7 min read

Are you afraid your prices are losing your market share? Afraid your competitors are offering the same services at lower prices? Afraid you could be pricing yourself out of potential sales? Afraid your services aren't worth what you're asking?

|

Key Takeaways

|

If any of these fears sound familiar, you're not alone. However, that doesn't mean you should start pulling your "lower prices" lever just yet.

Instead of immediately reducing your prices, you should first take a close look at your pricing strategy, get it under control, and ensure it's well-managed before you start slashing your prices like a bread-slicer salesman after the invention of sliced bread.

Here’s how to build the right pricing strategy for your business…

Are You Pricing for Profit? The Impact of Pricing on Profitability

When we think about profitability in your businesses, two factors come into play: costs and revenue.

To improve profitability, we can either cut costs or increase revenue, and one way to increase your revenue to improve profitability is with your pricing strategy.

When you're determining pricing models and prices for your business, you should be thinking about one thing: profits. Ultimately, if you're not pricing for profitability, then you're not pricing properly.

Read More: 3 Steps To Fix The Pricing Problems In Your Service Business

As a business owner, you have to have your sights set on your profits and this means determining your true costs (both direct and indirect) of goods sold and considering the actual value in your products and services.

While it's important to generate strong profit margins by not charging too little for your services, it's also important not to charge too much. As every consumer knows, there is a limit to how much we are willing to pay for certain products and services, and asking for more than your products or services are worth will price you out of the market, damaging your profits.

So, it's up to you to find a pricing strategy that fits into your larger business model while helping you hit the sweet spot between high demand for your services from plenty of customers who are willing to pay and generating enough revenue to achieve strong profit margins.

Which Pricing Strategy Is Right for Your Business?

There is a slew of pricing strategies out there that range from economy and market penetration pricing that intentionally offers low prices to gain market share for a new business to dynamic pricing that, like airline tickets, fluctuates based on supply, demand, and volatile costs.

In service-based businesses, there are two popular pricing strategies that are comparatively simple to manage and are designed to protect your profit margins while appealing to your customers. These are cost-based pricing and value-based pricing.

Cost-Based Pricing

Cost-based pricing uses your cost of goods sold and a target profit margin to set your prices. In a product-based business, cost-based pricing is a simple markup.

In service-based businesses, cost-based pricing is slightly more complicated because the vast majority of your business costs are going to be indirect which means you need to be able to properly determine the appropriate portion of indirect costs to allocate to each type of service you provide.

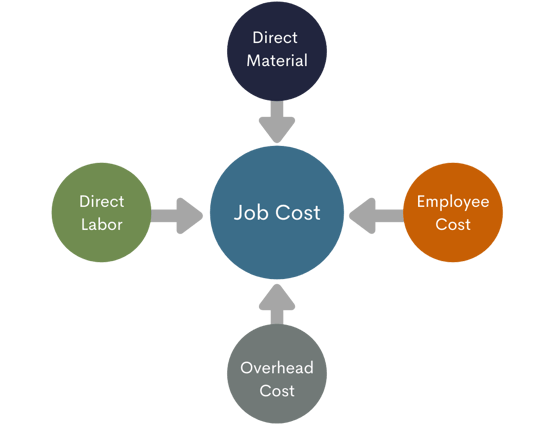

Although it can be complicated, it certainly isn't impossible. To successfully pull off cost-based pricing in a services business, you need to establish an accurate and efficient system for time-driven, activity-based job costing. This is the process of tracking and categorizing expenses, tracking employee time or measuring the time required to complete certain tasks, and then allocating indirect expenses to those various tasks accordingly.

Read More: Why Job Costing is Essential for Small Business Owners

Job costing allows you to determine your true costs in a service business so that you can build healthy profit margins into your prices and know that you can reasonably achieve your profit margin goals in reality.

Value-Based Pricing

Rather than starting with a desired profit margin and your costs, then adding a markup to achieve your targeted margin, value-based pricing more strongly considers the value of the services you offer. If you provide a white-glove experience or services that require highly educated, trained, experienced, and skilled professionals, then you should be charging value-based prices.

Examples of value-based pricing can be found everywhere. In product-based businesses, value pricing goes along with name brands and designer brands. For example, Apple can charge luxury prices for technology items that likely cost about the same to manufacture as less-expensive brands. [1]

In service-based businesses, experts can charge more for their services. For example, no one brags about hiring a cheap business consultant or the least expensive lawyer. Consultants and lawyers who are good at what they do provide high value to their clients, and they should charge accordingly. In these cases, charging less for their services than what they're truly worth could actually end up reducing the number of clients they bring in.

That being said, when you use value-based pricing, you don't have a free ticket to charge whatever you want. Take a look at what your high-value competitors are asking for their services and make sure you stay on par with the going rates.

While you still need to consider your profit margins and costs to effectively use value-based pricing, this strategy could help you strengthen your profit margins and even attract new business as a result of the increase in the perceived value of your services.

3 Goals at Which Your Pricing Strategy Should Aim

No matter what type of pricing strategy you choose to put to work for your business, you should keep the following three goals in mind:

1. Know Your Costs

If you don't know your organization’s costs, you simply can't know how much you need to charge to stay afloat.

Once you know your costs, have your accounting function conduct a break-even analysis to determine the bare minimum revenue needed to cover your costs. Then, work from there to determine the markup that will help you achieve your target profit margin goal.

2. Protect Your Margins

During a slump or a slow season in a seasonal business, advertising sales and offering discounts might seem like an attractive option to generate some revenue during a slow period. However, it's essential that you protect your profit margins to stay profitable.

If generating revenue costs you more than it's worth, then it's not really revenue anymore, is it?

Read More: Markup vs. Margin Formula: What Business Leaders Need To Know

In addition to only offering smart sales, be sure to check your P&L statements on a variety of job types, clients, and service types to determine which generates your strongest profit margins.

Even if a big client is responsible for a large portion of your revenue, they might be generating your weakest profit margins. In tough times, you might reconsider those clients or services that strain your resources.

3. Make Your Prices Attractive

While you need to charge what you're worth and enough to cover your costs and then some, it's also important to make your prices attractive to your clients.

This could mean getting creative with psychology (think $199 instead of $200) and service packages, subscriptions, or bundles that entice customers to buy more and continue to generate strong margins.

Is Your Back Office Holding Back Your Pricing and Profitability Analysis?

When it comes to pricing successfully, you need a strong back office with efficient, accurate, and automated processes. A robust back office will help you track expenses, track time, set prices, and measure how pricing changes affect your numbers.

Additionally, with a streamlined system established for job costing, you'll not only be able to set cost-based prices, but you'll also have the ability to pull profit and loss reports on different aspects of your business. With the ability to generate a P&L by job type, job, client, client type, or department, you can identify the true profit drivers in your business and eliminate the revenue channels that might actually be costing you money when all is said and done.

When it comes to profitability, pricing, and every other aspect of your business's management, building a better back office is your key to success.

.png?width=563&height=144&name=New%20GF%20Logo%20(37).png)