5 min read

To cut to the chase: Yes, in fact most businesses save anywhere from 30-40%, but that’s not the big reveal you’ll get from this.

When you outsource your financial operations, yes you save money, you also save time, your financials are managed by trained experts, and you’ll be able to focus more on doing what you do best: running your business.

All of that is important, but let’s take a quick look under the business back office microscope to see what it really looks like…

|

Key Takeaways

|

The Hidden Costs of In-House Financial Management

Overhead Expense

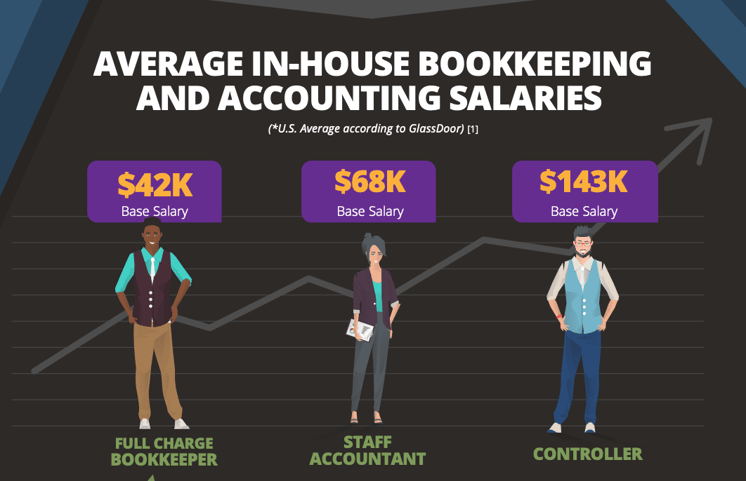

For growing businesses, hiring enough employees to round out your bookkeeping and accounting process entails a major overhead expense.

Typically, one person cannot and should not (stay tuned for the next point!) run your entire back office. Unless you're a tiny startup, growing a business requires more than one employee to handle the back office operations, and separation of duties is essential.

Put aside the fully loaded costs of their payroll, benefits, and office space– their training, knowledge and skill set will always be limited and transactional.

As your business grows, there are bigger issues to deal with: collections issues, cash flow issues, timely, accurate month end close, economic fluctuations, etc.

Outsourcing will save you money, but more importantly– having access to an entire team of bookkeeping and accounting professionals gives you invaluable peace of mind.

With in-depth experience and continuous training, reliability and staying on top of the latest industry trends, as well as the newest changes in regulatory compliance, outsourcing your accounting to a reputable service provider will give your business a much bigger advantage.

So, for a fraction of the cost of staffing your back office with in-house employees, outsourcing allows you to tap into the power and potential of an expert financial department, its industry experts, and the best financial tools available.

Risk and Internal Fraud

As mentioned above, only one or two employees should never have full control of your back office. One reason (we see 90% of the time) is the mistakes and penalties that happen because of one person doing all of the work, and worse, manual processes that result in consistent and significant errors. It's hard to manage a back office efficiently and effectively. You put your business at risk when you don't have separation of duties and a second set of eyes on your books.

Internal fraud is one of the biggest problems plaguing small and medium-sized businesses.

On average, businesses lose 5% of their annual revenue to internal fraud, the median loss rings in at $164,000. [1]

Small businesses fall victim to internal fraud much more frequently than larger companies. This type of loss might be insignificant for larger companies, but losses of this size represent serious financial trouble for smaller businesses.

Why are small businesses at such a high risk of internal fraud?

Small businesses typically lack internal controls and sound accounting processes that prevent opportunities for internal fraud from occurring. This is due to the inability to hire enough people to adequately separate powers and establish checks and balances.

Because of the close-knit nature of most small workplaces, business owners often place too much trust in their employees. Additionally, small business owners are generally more focused on their core competencies and are unaware of the tools and recommended processes that are available for implementing secure financial systems.

With outsourced accounting services, small business owners can afford the robust bookkeeping and accounting systems that protect larger companies from internal fraud. With access to expert controllers and an experienced financial team, you can establish sound accounting systems and shield your small business from the risk of financial loss due to internal fraud, mistakes and penalties.

Download the full infographic here! (PDF)

Download the full infographic here! (PDF)

The True Cost: Wasted Resources and Collateral Damage

In addition to potential internal fraud losses and overhead expenses, there are indirect costs associated with the money and time dedicated to handling bookkeeping and accounting processes 100% in-house that are more difficult to calculate.

How much does in-house bookkeeping and accounting truly cost?

There is a major opportunity cost here. Outsourcing can help you gain valuable time back and improve productivity. Imagine what you could accomplish if the number of dollars and hours being spent on manual back office procedures had been dedicated to developing, improving, and strengthening your core competencies.

If you have an internal bookkeeper that you’ve outgrown but don't want to lose, you could elevate this employee who’s knowledgeable about your business, into a profit generating role, or sharpen their skills in HR.

How Outsourced Accounting Is Different Today

Outsourcing is not what it used to be — in a good way.

For many, the idea of outsourcing still brings to mind images of overseas call centers and cheap manufacturing.

Twenty years ago, outsourcing solely existed to slash costs by sending jobs overseas where labor and materials could be acquired for much less. While some of that type of outsourcing still goes on today, there are better ‘remote’ solutions available that not only continue to save you money, but also help you increase revenue.

Thanks to the rise of technology, business process outsourcing (BPO), has become one of the best ways for businesses to make the most of their limited resources to overcome challenges in the pursuit of success. This type of outsourcing centers around outsourcing core business functions.

Whether you outsource your marketing, IT security, or bookkeeping and accounting processes, this type of outsourcing empowers small and medium-sized businesses to strengthen their core competencies, improve workflow, and benefit from other people's resources, while still saving money on overhead costs.

Business process outsourcing focuses on forming relationships in which companies and the outsourced people with whom they work have become more like partners. Together, businesses and their outsourced teams work toward mutually beneficial goals that generate more revenue, create new opportunities, improve decision-making processes, and increase success all around.

With outsourced accounting specifically, your company will benefit from the highly trained accounting professionals that provide access to expertise that would be out of most small business’s budget. This expertise can help identify new ways to save money in your business, generate more revenue, and boost your profit margins.

[WATCH] Is It Time To Outsource Your Back Office Financials?

Outsourcing your company's back office will help you create smarter, safer, and more efficient processes. The expertise of a high-quality outsourced accounting partner will enable you to set smart business goals, take control of your business drivers, and make data-driven decisions to rally your employees around common benchmarks to work step-by-step toward success.

Create an Efficient Company Back Office with Outsourced Accounting Services

Imagine what it would be like to have bookkeeping and accounting systems running like clockwork, the expertise of an entire back office team just a phone call away, and the power to identify and control your business drivers. Sounds pretty incredible, right?

With scalable, outsourced management accounting services this is all possible — even for small businesses. With outsourced accounting services, small businesses can leverage the most advanced bookkeeping and accounting tools to streamline their in-house back-office processes. They can tap into the wisdom of experienced controllers, CPAs, management accountants, and bookkeepers.

Small businesses can start setting smart goals based on actionable data. You can start taking real, strategic steps toward your business's success.

Establishing an efficient back office means that you'll no longer be hindered by your company's financial processes. Instead, you'll be able to spend your time the way the most productive business leaders do. You'll find yourself buoyed by the wealth of information, in full control of your business, and empowered to make the data-driven decisions that will lead your business to success.

.png?width=563&height=144&name=New%20GF%20Logo%20(37).png)