Survival

Manage Your Cash Flow in a Crisis

The difference between the companies that survive a crisis and those that don't? Focusing on cash flow. Now more than ever, managing your cash flow is the lifeblood of keeping your business on the right path. Start with your cash flow forecast - your projected sources and uses of cash, then revisit cash flow best practices. You'll be able to navigate the road ahead and recover more quickly.

Restructure

Make Data-Driven Decisions

Your emotions are heightened, but it's never a good idea to just make decisions on emotions. Stick to the data. If you don't have a forecast, now is the time. It's simple and we can walk you through the steps. Regardless of how much you anticipate the impact will have on your business, a budget will help you navigate this financial crisis. We'll work with you and your staff to get it done so you could make good decisions.

Strengthen

Improve Integration & Automation

You suddenly have the capability to transfer a lot of information faster, with fewer errors and lower cost because of less labor and more efficiently. We can help you improve system design, get staff trained to work smarter and to clean up your books. It's what we do.

Helpful Resources

As COVID-19 continues to spread, we've created a resource center to guide businesses through this unprecedented global crisis.

COVID-19 and Your Business Financial Management Strategy

This pandemic is unlike any previous crises, and a “traditional” crisis response may not be sufficient. It's important to adapt to the changes both tactfully and strategically. Here are tips and best practices to help you navigate these uncharted waters and mitigate organizational risks... .

[WEBINAR] How to Weather the Storm - 5 Steps to take now.

Regardless of the impact this crisis will have on your business, changes will have to be made. Depending on which scenario you fall into: A. Survival (your business may not make it), B. Restructure (you'll make it but need to make hard decisions), or C. Strengthen (Your business will be ok, use this time to make it stronger) – These five steps will help you get navigate the best route forward.

Add a COVID-19 Expense Line Item

Consider adding an expense line item called COVID-19, and capturing ALL information directly related to Covid-19. This includes any related material & supplies, as well as any your staff and personal time spent dealing with a crisis. Watch Ron Lovett, author of Outrageous Empowerment, explain more on how to update your COVID-19 expense items

COVID-19 pandemic: How to prepare your business | Insperity®

By being well versed in the facts, business leaders can play a critical role in soothing employees’ concerns, modeling healthy behaviors and keeping their workplaces relatively productive – all while not running afoul of related laws and regulations.

Financial Projection Template | SCORE.org ®

Financial projections use existing or estimated financial data to forecast your business’s future income and expenses. Download this financial projections template to calculate your small business expenses, sales forecast, cash flow, income statement, break-even analysis & more.

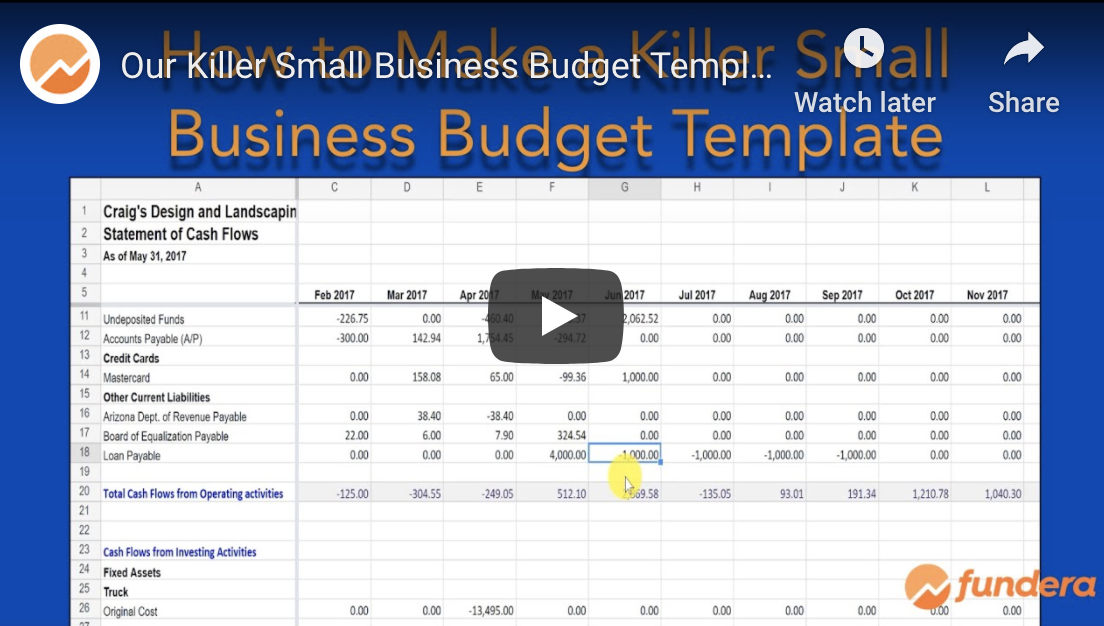

Budget Template | Fundera ®

Many people think of budgeting as their least favorite part of running a business—but if you want to be successful, creating and maintaining a proper business budget will be a critical component of that success. Here’s a step-by-step guide for how to create a business budget.

Learn to Automate Small Business Bookkeeping with Bill.coms

Bill payment no longer has to be a time-consuming and costly accounting task for small businesses. As for the cost savings, The Wall Street Journal estimated that the average small business spends $12 to pay a bill. By using Bill.com to pay bills electronically, the cost to pay a bill can be slashed to around $1.50.

SBA Disaster Assistance

The United States Small Business Administration offers disaster assistance. The SBA offers disaster assistance in the form of low-interest loans to businesses, renters, and homeowners located in regions affected by declared disasters. The process to apply for disaster assistance is simple.

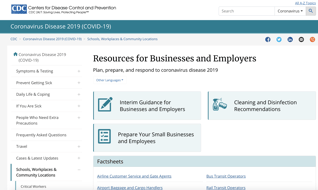

CDC Coronavirus Disease 2019 (COVID-19)

The CDC has collected resources for Businesses and Employers to plan, prepare, and respond to coronavirus disease 2019. Find interim guidance for businesses and employers, cleaning and dissinfection recommendation, and how to prepare your small business and employees.

COVID-19 Small Business Resources

America’s SBDCs are working to help small businesses address the challenges of the coronavirus disease 2019 (COVID-19) pandemic. Find SBDC Webinars for Small Businesses, SBDC Materials for Small Businesses, and how to contact your local SBDC now. See more on federal disaster loans.

"GrowthForce is excellent to work with because they're very responsive, and they're very knowledgeable. I feel like they're family. We live miles apart, but at any point in time I pick up the phone, or send an email, I usually get a response within a few minutes."

Jacqui Tricco

Director of Business and Finance, OneFuture Coachella Valley