.jpeg?width=684&height=456&name=AdobeStock_605089221%20(1).jpeg)

Small to Medium sized businesses, may start to feel as though their business has outgrown QuickBooks and that it may be time to find an alternative accounting solution.

Before you decide whether or not you are ready to leave QuickBooks, you have to define what you need from an accounting system.

Switching accounting systems, going upmarket from QuickBooks, is expensive. Before you decide to switch you should analyze whether you can leverage QuickBooks and it’s ecosystem of add-on apps before you make that jump. If you are missing some functionality, check out Intuit's website for a searchable database of the apps that have built in integration with QuickBooks. If you are missing something in QuickBooks you’ll probably find it there, but first read on...What Decisions Do You Need to Make?

Most people get frustrated with QuickBooks because of the reports. To figure out what you need, start with the end in mind. Write down the decisions you need to make to help your business make more money. Then you can figure out what reports you need to see every day, every week, every month, every quarter and at the end of each year. All of your key stakeholders - The CEO or president, each budget manager, the accounting staff, the board, and any external users, (CPA, the bank, or investors,) should be asked what decisions they need to make, so you can create a list of key reports needed to inform those decisions.

This all comes back to the question - Why do you do accounting? The answer should be to make more money, or if you are a nonprofit, it’s to make sure you maximize your limited resources to advance your mission.

So, if you want to make more money or manage better, you need to decide if you are getting what you need out of QuickBooks or if you've outgrown it.

If you can't get the reports you need in order to make the decisions you need to make, then it may be time to find another solution.

How do you create the right reports? You unleash the power of QuickBooks to get those reports to help you make more money.

Have you unleashed the power of QB?

Most people use QuickBooks the way they use Excel - they just use the basics add, subtract, multiply and divide, or as a simple way to print pretty reports.

But Excel has tremendous power that is not unleashed. Only a fraction of the users use pivot tables. Even a smaller group use VLOOKUP, and sort and filter the data, and really use the Excel spreadsheet as a database for analysis.

The same thing is true with QuickBooks. You have all this incredible power, but very few businesses know how to really unleash that power to benefit their business. They don't create custom fields and custom filters to drive custom reporting, nor do they know how to do things like activity-based costing or accruals at month-end.

It costs money to generate a report. It costs money to review the reports. It costs money to distribute the reports. Just because you can generate a report, doesn't mean you should.

And, it’s not just the cost. When people get a report and don't know what to do with the report it makes them feel incompetent. That's worse than not looking at a report at all. The rule in reporting design is, less is more. Understand why you need each report and you’ll be on your way to being able to make data-driven decisions.

What drives an organization to move from QuickBooks?

People think they need to move off of QuickBooks because...

(True or False)

The database isn't designed to handle large quantities of data or multiple users.

= False.

Database Performance

Well that may be true for Quickbase Pro (Essential) and Quickbase Premier. Because those use a slimmed down version of a FoxPro database, and that is not a scalable database. It doesn't have the speed to handle it, nor was it designed for it. But, what do you expect? Quickbase Pro (Essential) costs you $189.

QuickBooks Enterprise edition uses a proprietary version of a SQL database. The performance of QuickBooks is fast and reliable. To verify this, we went to an expert at Custom Business Software to run a speedtest on the performance of QuickBooks.

The Performance of QuickBooks

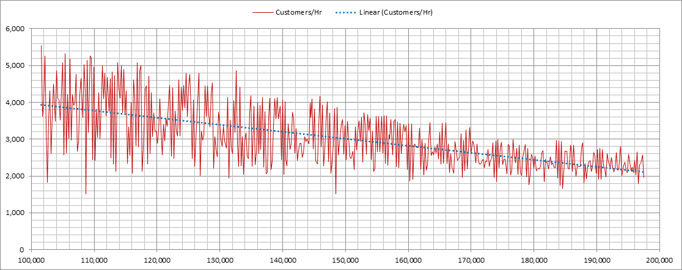

"Customer base or invoice base transactions (of up to 200k) showed no degradation in performance throughout the entire test." ~ Corey Prator, Custom Business Software

There is a minor degradation in performance as more customers get added, but it doesn’t matter - We were able to load about 1 customer per second which is more than sufficient for a small to medium-sized business. Here’s the performance chart from the test:

People think they need to move off of QuickBooks because...

QuickBooks can't make or receive foreign currency payments.

= False.

Foreign Currency

Most people don't realize that QuickBooks has foreign currency capability. It allows you to do billing and receive payments in a foreign currency, and to receive vendor bills, but you can’t pay the bills in foreign currency. You can record them in the foreign currency, and have it not only record the foreign currency amounts for payables and receivables and income and expenses on your books automatically, it also, at the end of each month, will automagically go in and calculate the foreign currency gain or loss based on the change in conversion rates.

The great thing about foreign currency capability in QuickBooks - if you sell a $1,000 item, and the peso today is 1 to 1, it's going to record it as $1,000 pesos on my books today. Next month, if the peso is devalued, and it's now only worth $0.80 - QuickBooks will automatically record what's called the unrealized foreign exchange gain or loss. It changes the receivable to $800 U.S. dollars even though it still shows as 1,000 pesos. It goes through the web to get the Foreign Exchange Spot Rate on the last day of the month, and calculates the unrealized gain or loss. That's not what people expect out of QuickBooks; it’s very sophisticated. A negative point about QuickBooks foreign currency, is that once you turn it on you can't turn it off, and it slows the database down, because it has to go through every single transaction to do a foreign currency conversion. So, if you have a very large database, or if you have very few transactions that are foreign currency, you may want to consider another option.

People think they need to move off of QuickBooks because...

The only way to get consolidated reporting is to copy and paste reports into Excel.

= False.

Consolidated Reporting

QuickBooks has so much power that people aren’t aware of.

Consolidated ViewsQuickBooks Enterprise edition has the ability to do consolidated reports. But, there's a couple of things that are important to know. From an accounting perspective, it's really called a combination, not a consolidation and, to an accountant, there is a difference.

But to a non-accountant, In QuickBooks, you're combining multiple QuickBooks files into one report that can be exported into Excel.

If you want to do a true consolidation, you can add up all the companies, combining them all together, but you eliminate intercompany transactions by putting them in a separate QuickBooks file. The the combined totals will be a consolidated financial statement.

Here’s an example: If I'm in Mexico and I sell to the U.S., I'm gonna show revenue in Mexico, and I'm going to show the transfer price expense in U.S. - But when I consolidate the reports, I don't want to include in-house (U.S. operations) revenue from Mexico to U.S. operations, because it overstates my revenue, and overstates profits. That would mean I'm going to have to pay taxes on income that I really didn't sell to a customer, I just transferred from one place to another, but Mexico has to get credit for budgetary purposes for the sale.So, you should eliminate intercompany transactions.

We recommend that you create another QuickBooks file that is just for intercompany transactions, so that when you combine all the companies together, it will eliminate them using that elimination company.People think they need to move off of QuickBooks because...

You can’t lock down prior periods or separate duties.

= False.

Lack of Internal Controls

QuickBooks certainly does not lack controls, and many times there are workarounds for the things you want to accomplish, before moving to another accounting system with more features, higher costs and oftentimes less control.

QuickBooks has a full system of internal controls, and there's an audit trail for every transaction. How do you lock down a user? You can give them the right at the screen level to view, edit, modify, delete, or any of the above, or any combination thereof.People think they need to move off of QuickBooks because...

The General Ledger in QuickBooks isn’t designed to track departments, profit centers, locations.

= False.

Lack of Ability to Customize

Customize with Class

In QuickBooks - this is exactly what the Class function is for. Class is used for any unit that you want to run on your own profit and loss. Typically, that's a profit center or a cost center, which also means by department. Profit center and cost center is a fancy way of saying departments.

Consider Sources of Revenue

Profit centers are the departments that have revenue. Cost centers are departments that don't have revenue. Accounting is a cost center. HR is a cost center. Service is a profit center.

The tricky one is sales. What would you think of sales - Is it a profit center or cost center? Marketing and sales do not directly generate revenue - no clients are paying the company for the sales person - they're paying the company for the product that sales is selling. They're paying for service people to do the work; they are not paying for the salesperson to sell the work. Sales is a cost center. It's the cost of acquiring revenue.QuickBooks = Flexibility

If you can't get what you want out of QuickBooks, contact an expert to unleash the power of QuickBooks. Before you make the switch make sure that you understand the trade-offs. If you move into a more detailed and specific industry system, you're going to have less flexibility, and that's okay if you have a report writer on staff. If you have somebody who can do the reports then you may be able to get what you need. There are report writer programs such as Microsoft FRx for example that could be used to get reports, because you're not to going get that in most of the larger accounting systems. So, that's a big risk -- the lack of flexibility.

More power means more rules.

When you switch from QuickBooks to another accounting system, you are typically looking at a very expensive alternative. You can get QuickBooks setup usually well under $10,000.

Whereas, if you move into a middle market accounting system, like Microsoft Dynamics™, Sage®, or NetSuite®, you're talking about a minimum of $20K to $30K (normally, about $50,000 to $75,000 and more).

And, in the current world of accounting systems, there's nothing in between. QuickBooks is on the low end, but none of the alternatives on the low end accounting systems (MYOB, Peachtree®, Microsoft® Money) are anywhere close to the power of QuickBooks, so there's really no alternative.

Often companies prematurely spend up to $50,000 and they get into a system that doesn't have the same flexibility they’re used to. And, so they come back and they say, "I wish I'd never changed, because if I wanted a report in QuickBooks, I just go in and get it." If you want a report in other accounting systems, you may have to get additional software and hire a report writer to create the report for you.

How to Get the Maximum Potential of QuickBooks

Optimizing your system and processes should be your first checkpoint in getting the most out of your current system. Working with an advanced certified QuickBooks ProAdvisor, who can help you to tap the fullest potential of QuickBooks, is the second most important part to unleash its power.

Understanding what decisions you need to make, and the reports you need to help make the data-driven decisions that will help your business grow is where you should start.

Have you unleashed the power of QuickBooks? If not, you can find an advanced certified proadvisor through Intuit® to help you, or you can set up a 15-minute consultation with us.

Is your system optimized and scaled to meet the needs of your growing business?

Are you working with a company that can help you unleash that power?

Be sure to explore all the options available to you before you make the jump to get off QuickBooks.