7 min read

Your business is growing- congrats! But, with growth comes an increased responsibility for your back office, and your bookkeeper might need help keeping up.

|

Key Takeaways

|

How Much Should You Be Paying for Bookkeeping Each Month?

The costs a small business or nonprofit incurs for bookkeeping will depend upon many variables.

Company size and lifecycle, number of monthly transactions, number of employees and how payroll is processed, number of expense accounts, credit cards, invoices to send out, bills to pay, number of balances sheets to reconcile, etc. In addition to these basic bookkeeping activities, your costs will be impacted by how your accounting systems, policies and procedures, and reporting needs are set up and administered.

Basic Bookkeeping vs. Full Service Accounting

Many small businesses in the early stages are primarily concerned with compliance – paying bills, getting paid, recording transactions, ensuring payroll accuracy, and following state and federal regulations. At some point, your business will cross a threshold and you’ll begin to place more emphasis on the need for timely, accurate financial reports and intelligence. This is when you’ll need more advanced bookkeeping, accrual-based accounting, and management or managerial accounting to help you make data-driven decisions.

So your first consideration is whether you just need compliance – basic bookkeeping - or if you’re ready to graduate to full-service accounting that will help you drive increased profits, improved cash flow and growth. They require very different levels of effort and expertise and as you can imagine, the cost for full service accounting is much higher. However, most businesses that make the leap see the value and experience an ROI rapidly.

What Does a Bookkeeper Do for Your Small Business?

Bookkeepers are in charge of maintaining your books closely day in and day out. They generally do all data entry into accounting ledgers or software.

They focus on recording the financial transactions of a business through maintaining records, tracking transactions, and creating financial reports.

Other duties include:

- Entering, Coding and Paying Bills

- Creating and Sending Customer Invoices

- Collecting Past Due Accounts Receivable

- Reconciling Bank and Credit Card Accounts

- Maintaining Vendors for Accounts Payable and Clients for Accounts Receivable

- Supporting CFO/Controller and Outside CFO by preparing:

- Account Analysis

- Work Papers for Month-End Closing and Audit Support

- Scan & Attach Documents for Tax and Audit Support

- Preparing Client Source Documents (PBCs) For Audit Support

Read More: The Pros and Cons of Outsourcing in 2023

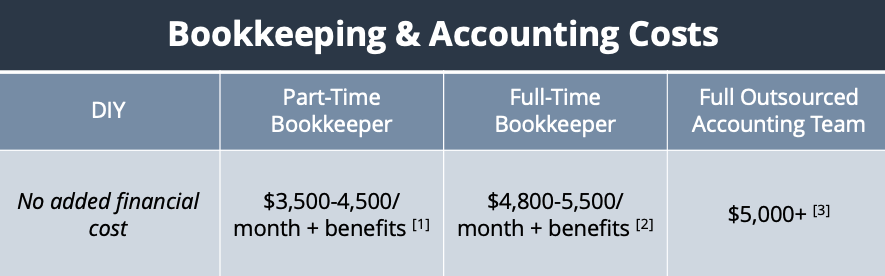

Basic Bookkeeping Costs – Part Time vs. Full Time vs. Outsourced

If basic bookkeeping is all that your company needs at this stage, you’ll need to decide whether to do the bookkeeping in-house or if you should outsource. If you decide to hire and manage a bookkeeper you’ll also have to decide whether the position is part-time or requires full time. If you decide to outsource, there are a few ways to go including local bookkeeping services, local CPA firms that offer bookkeeping services and specialized, national outsourced bookkeeping firms. Let’s look into three different options your company could consider to fill this need...

Part-Time Bookkeeping for Small to Medium Businesses

The cost of a part-time bookkeeper can vary widely. Hourly rates for internal, part-time average around $21-23/hour depending on job description and location.[1] They typically are performing basic bookkeeping duties and will need to be supervised and managed.

If you can manage your job and some of the accounting each month but need a little extra help, a part-time bookkeeper might be a good fit for your business. They can do work such as inputting receipts and tracking employee timesheets, accounts receivable and accounts payable. When hiring a part-time bookkeeper, management still needs to have someone reviewing the work of the bookkeeper.

Often businesses try to train an office manager or other employee with capacity to become the part time bookkeeper. While this can work and is often the least expensive option on paper, there are risks associated if the part time employee’s or office manager’s output does not measure up to standards. And the cost of oversight, usually in the business owner’s time, can be significant.

Full-Time Bookkeeping for Small to Medium Businesses

The current average full-charge bookkeeper's salary fluctuates between $48,000 to $70,000 per year plus benefits and overhead, depending on your location.[2] According to Glassdoor, current listings in high cost of living cities like New York or L.A. show the salaries creeping towards $70K. In addition, you’ll need to add around 20% on top of salary for benefits and overhead including office space.

A full-time bookkeeper handles the day-to-day accounting functions for your office. Keeping your books in order and up-to-date is the foundation of the financial strength of your business. Hiring a full-time bookkeeper in this situation could be the right answer for you.

You can expect a full charge bookkeeper to run operations associated with paying bills, billing clients, managing time-sheets and payroll, and processing financial statements at month end. As a business owner, you will still need to look over the end results to guarantee accuracy.

In-House Vs. Outsourcing: The Real Cost Savings 👇

In-house bookkeeping & accounting employees could actually be costing you more, while delivering less. It's time to unveil the truth behind the numbers and unleash the potential for growth within your organization.

Click HERE To Download The Full Infographic (.pdf)

Outsourcing Bookkeeping for Small to Medium Businesses

Just as with hiring an internal bookkeeper and defining their role, you’ll have to decide which pieces of your financial management make sense to outsource including the bookkeeping function. The average price of outsourcing your bookkeeping needs ranges depending on the number of transactions and complexity of services required. A key benefit of Outsourcing is it gives you the ability to customize the services you receive to your bookkeeping needs.

In addition, you can outsource more advanced management accounting and Controller/ CFO functions to receive a complete “virtual accounting department”, which will certainly add to your monthly fees but could be what you need at this stage in your growth cycle. If your business is moving into a growth stage, you need to consider graduating to full accrual based accounting, with financial and management reports that help you scale. Typically you will need this level of financial management not only for yourself but for your key stake holders including banks, investors and advisors.

If either part-time or in-house bookkeeping is not the ideal solution, switching to outsourced bookkeeping or accounting could be your best option. Many businesses are concerned about switching over to outsourcing, not understanding how the pieces fit together with this model. But with today’s advancements in technology, outsourcing has never been easier. Outsourcing can provide advanced and less costly bookkeeping service than a typical in-house bookkeeper.

Outsourcing also offers many benefits that you can’t get with an in-house bookkeeper. Today there are many different kinds of back office outsourcing companies, ranging from project-only outsourcing, hourly rates, flat recurring monthly service fees, and a la carte packages to fit each business’s unique needs. If you're growing, the outsourced bookkeeping service should be able to help you scale by adding full service accounting when you are ready for it.

Another benefit of moving your bookkeeping to outsourcing is that you might be able to change the role of an existing employee e.g. the part time bookkeeper, and move her to a revenue generating role instead of an expense. Free up your good employees to help you focus on growth!

Which Type of Bookkeeping is Best for Your Company?

There are major differences between the three types of bookkeepers and what each can offer your business. Figure out which works for your business and start tackling the problems, or potential problems, with your books.

GrowthForce can serve as your outsourced advanced bookkeeping and accounting department. We provide outstanding client service with a United States-based team of a bookkeeper, staff accountant and controller who provide the expertise you need to help your business improve cash flow and increase profits.

Read More: Fuel Business Growth With Outsourced Accounting in 2020

[1] https://www.glassdoor.com/Salaries/bookkeeper-part-time-salary-SRCH_KO0,20.htm

[2] https://www.glassdoor.com/Salaries/full-charge-bookkeeper-salary-SRCH_KO0,22.htm

[3] https://www.growthforce.com/blog/cost-analysis-outsourcing-vs.-in-house-accounting-for-your-business