.jpeg?width=677&height=451&name=AdobeStock_605056886%20(1).jpeg) In our eBook, The CEO’s Guide to Keeping Score, we address 5 sections of a CEO’s brain to help visualize where, as a strategic CEO, you need to spend your time. Then, we discuss the 5 related scorecards and KPIs we designed to help CEOs get the information they need to make data-driven decisions.

In our eBook, The CEO’s Guide to Keeping Score, we address 5 sections of a CEO’s brain to help visualize where, as a strategic CEO, you need to spend your time. Then, we discuss the 5 related scorecards and KPIs we designed to help CEOs get the information they need to make data-driven decisions.

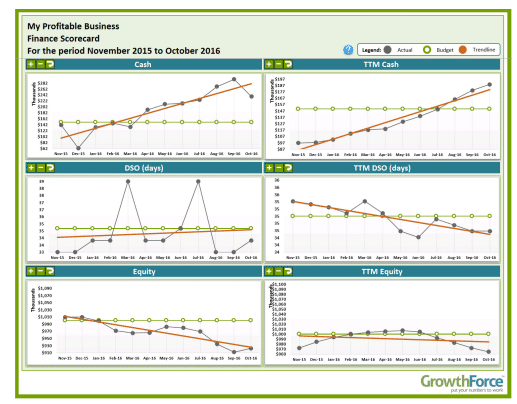

In this blog, we focus on Cash & Finance - The Finance Scorecard

The forefront of the CEO brain is focused on cash flow. If cash flow is an issue in a business, a CEO is forced to act tactical. If cash flow is an issue, getting cash in the bank is what consumes the CEOs. They think about it in the shower and when their head hits the pillow at night.

They look at the bank balance every day. If cash flow is a problem, the business most likely isn’t hitting sales targets or pricing its jobs correctly. They haven’t watched their revenue per hour paid versus the total labor cost per hour paid.

They look at the bank balance every day. If cash flow is a problem, the business most likely isn’t hitting sales targets or pricing its jobs correctly. They haven’t watched their revenue per hour paid versus the total labor cost per hour paid.

Once again pricing jobs is the most important decision a CEO will make. That’s why it is critical for CEOs to use job costing to understand the true costs of their jobs, and price according to a targeted gross profit margin. The failure to follow that process is what causes cash flow problems for a business.

Clients & Services Questions a Strategic CEO should be thinking about:

CEOs with cash flow problems are often forced to make tactical, not strategic decisions. It’s the single biggest reason why businesses fail. It becomes a downward cycle in that CEOs make bad decisions on pricing because they are driven by the need to get the next check, not what’s best for the their business strategy.

That’s how small businesses fail.

- How much cash do we need to invest in growing the company?

- Are we doing our best to quickly get paid for the work that we do?

- How can I improve profits by investing in operational efficiency or outsourcing non-core functions to lower costs and improve that function?

The Finance Scorecard

The finance scorecard is directly related to all other business scorecards. Since the purpose of the company is to make money, finance is driven by sales and marketing, service and people metrics.

More than simply having a relationship with all the other business functions, finance has its own issues to track, including cash flow, EBITDA (earnings before interest, tax, depreciation and amortization) and DSO (daily sales outstanding).

Charts in the Finance Scorecard

- Cash Balance

- Days Sales Outstanding

- Equity

Cash flow: many businesses have cash flow problems. Usually, those problems come from pricing jobs too low or from not implementing best practices in billing and collections.

Many business owners think that they can solve any problem just by selling more. That technique will work, only if you are able to sell good business, getting the target profitability on each client, and make sure that you're pricing jobs right.

However, if you sell low-margin business, that practice will extend your cash flow problems, not solve them. Service KPIs should focus on customer and job profitability as well as employee retention. Predictable and reliable employee output allows you to plan for the future.

Service KPIs should focus on customer and job profitability as well as employee retention.

EBITDA: Earnings before interest, tax, depreciation and amortization are a measure of a company's operating performance. EBITDA lets you evaluate a company's performance without having to factor in financing decisions, accounting decisions or tax environments. EBITDA is a great placeholder for cash flow. If you have strong EBITDA you’ll have great cash flow.

Days Sales Outstanding: The DSO ratio is the accounts receivable amount divided by the average sales per day.

DSO measures the average age of your accounts receivable. If your DSO average is trending up, then your business is more likely to struggle with cash flow. Knowing your DSO can help you determine whether to outsource collections or to simply improve your current billing and collections processes and policies.

Additional/Advanced Finance KPIs

- Return on Assets / ROA – Return on assets, or ROA, tells you what percentage of every dollar invested in the business was returned to you as profit.

- Return on Investments / ROI – Return on Investments / ROI sometimes is used the same as ROA, but often is used to tell the ROI of specific investments such as a marketing campaign.

- Return on Equity / ROE – Return on Equity or ROE tells what percentage of profit you make for every dollar of equity invested in the company.

Making Every Penny Count

Taking all of these KPIs and factors into account, then, you can truly be a strategic CEO and price jobs correctly. While the objectives of making money and ensuring cash flow are absolutes in a business, there are certain, human elements you must be aware of in conjunction with these efforts.

By having a firm understanding of your finance scorecard, you’ve set up your organization for long-term success; you’ll never be scraping by, or wondering why cash flow isn’t consistent.

It’s all about keeping score. To learn more, check out our Keeping Score eBook to truly take the next strategic step in controlling and regulating your business’s finances.